Bonk Rockets 30% to Lead Dog Meme Rebound; Floki Termed 'Utility Token' by CFTC

Solana-based bonk (BONK) led growth among dog-themed memes Saturday as bitcoin staged a recovery rally to above $98,000, a day after Friday’s bloodbath that pushed it near $93,000.BONK surged 30%, CoinGecko data shows, with dogecoin (DOGE), shiba inu (SHIB), dogwifhat (WIF) and floki (FLOKI) surging as much as 20%. The dog-themed token category gained 8% on average in the past 24 hours, beating a market-wide jump of 4.5% as tracked by the broad-based CoinDesk 20 (CD20) index.Memecoins are known for their high volatility and tend to outperform major tokens during price rallies, serving as a leveraged bet on the overall crypto market sentiment.However, in this case, fundamentals are helping back gains and sentiment among some memecoins. FLOKI was named alongside ether (ETH) and Avalanche’s AVAX as a utility token in a Commodity Futures Trading Commission (CFTC) meeting last month.The derivatives regulator proposed in a Global Markets Advisory Committee (GMAC) a new class of assets termed utility tokens, which fulfill six criteria that include providing their holder “immediately available, non-incidental consumptive use” in a crypto platform without including “governance and voting abilities.”"FLOKI was recently highlighted by the CFTC's Global Markets Advisory Committee as a case study of a utility token, which is a big deal and validates Floki's utility-first approach,” Floki lead developer B told CoinDesk in a Telegram message. “Floki's Valhalla metaverse game will go live in early Q1 2024, and the recently released Floki Trading Bot has generated over a million dollars in fees.“This puts Floki on an entirely different level from other memecoins, especially when the market turns and people start to pay attention to fundamentals again,” B added.Elsewhere, interest in BONK comes as a host of activities intend to deflate token supply gain traction among users — a move that has historically contributed to higher prices.BonkDAO, a decentralized group of bonk believers that maintain the token, burned 100 billion tokens from the circulating supply in November and targeted a trillion token burn in December. This could increase the token's value due to scarcity.

The feat could meet its target in the weeks ahead, observers say.

Read More

Tether Takes $775M Stake in Video-Sharing Platform Rumble; RUM Shares Soar 41%

YouTube competitor Rumble (RUM) is in a deal for a $775 million strategic investment from stablecoin giant Tether.Rumble will use $250 million of the money to support operations and the remainder to fund a tender offer for up to 70 million shares of its common stock at a price of $7.50, according to a Friday evening press release. That $7.50 is the same price per share Tether is paying for its stake."I truly believe Tether is the perfect partner that can put a rocket pack on the back of Rumble as we prepare for our next phase of growth," said Rumble CEO Chris Pavlovski."Legacy media has increasingly eroded trust, creating an opportunity for platforms like Rumble to offer a credible, uncensored alternative," said Tether CEO Paolo Ardoino. "Beyond our initial shareholder stake, Tether intends to drive towards a meaningful advertising, cloud, and crypto payment solutions relationship with Rumble."RUM shares have rocketed higher by 41% in after hours action to $10.13.It is not known if any of the proceeds will be used to put bitcoin (BTC) on the Rumble balance sheet. Pavlovski in November had teased an interest in his company possibly buying bitcoin.

Read More

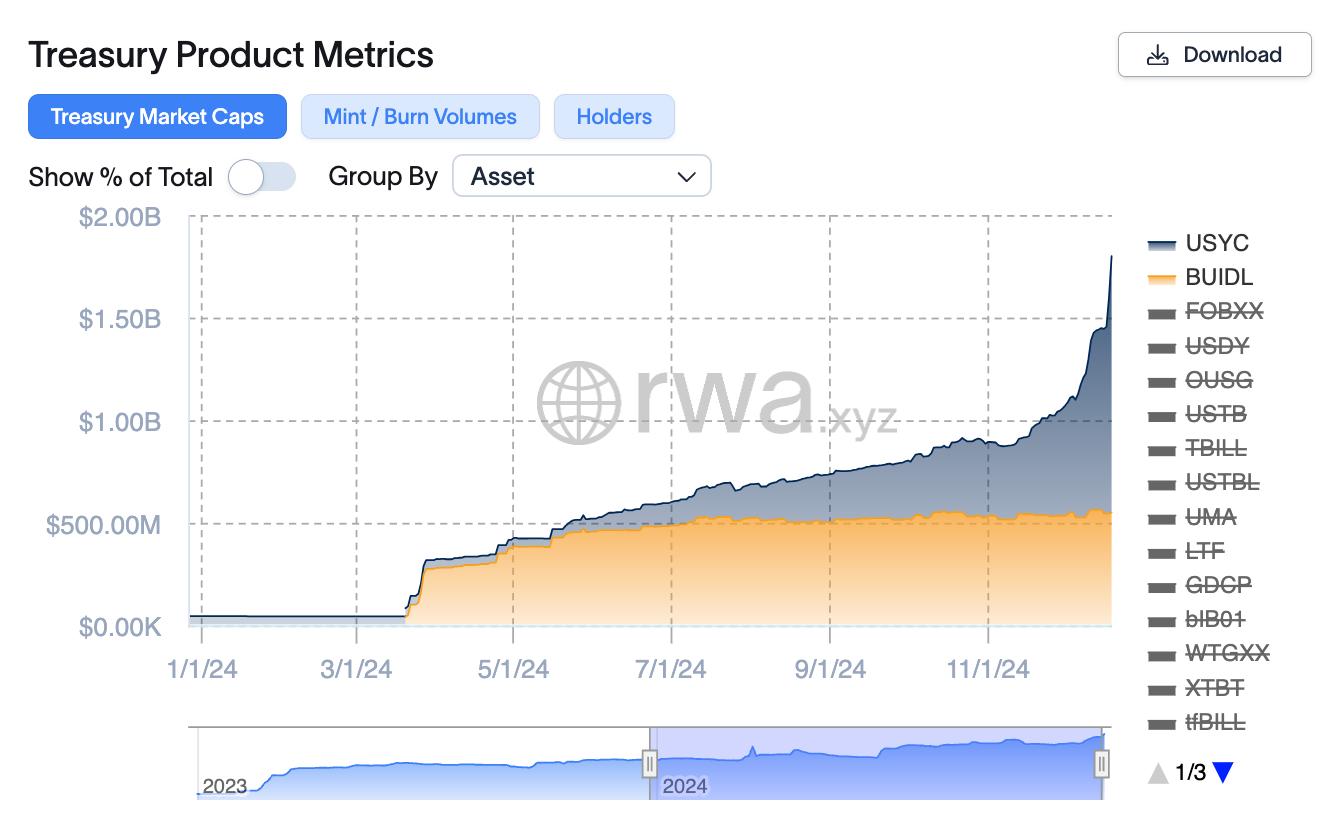

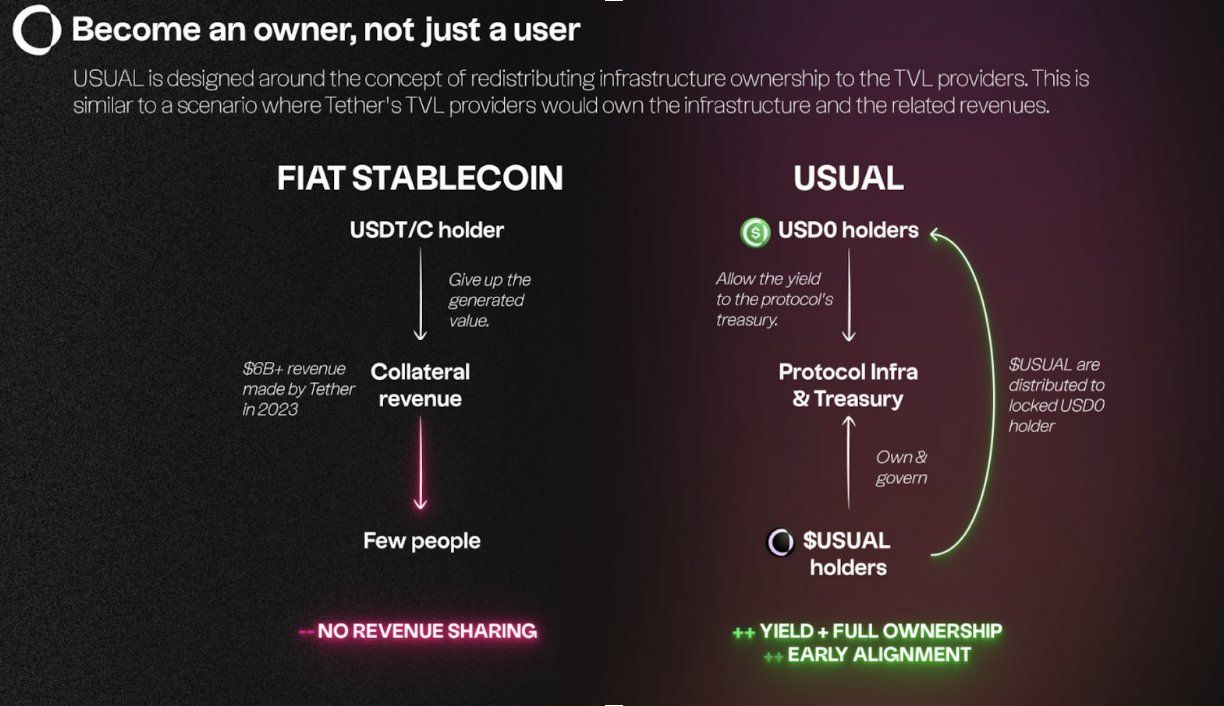

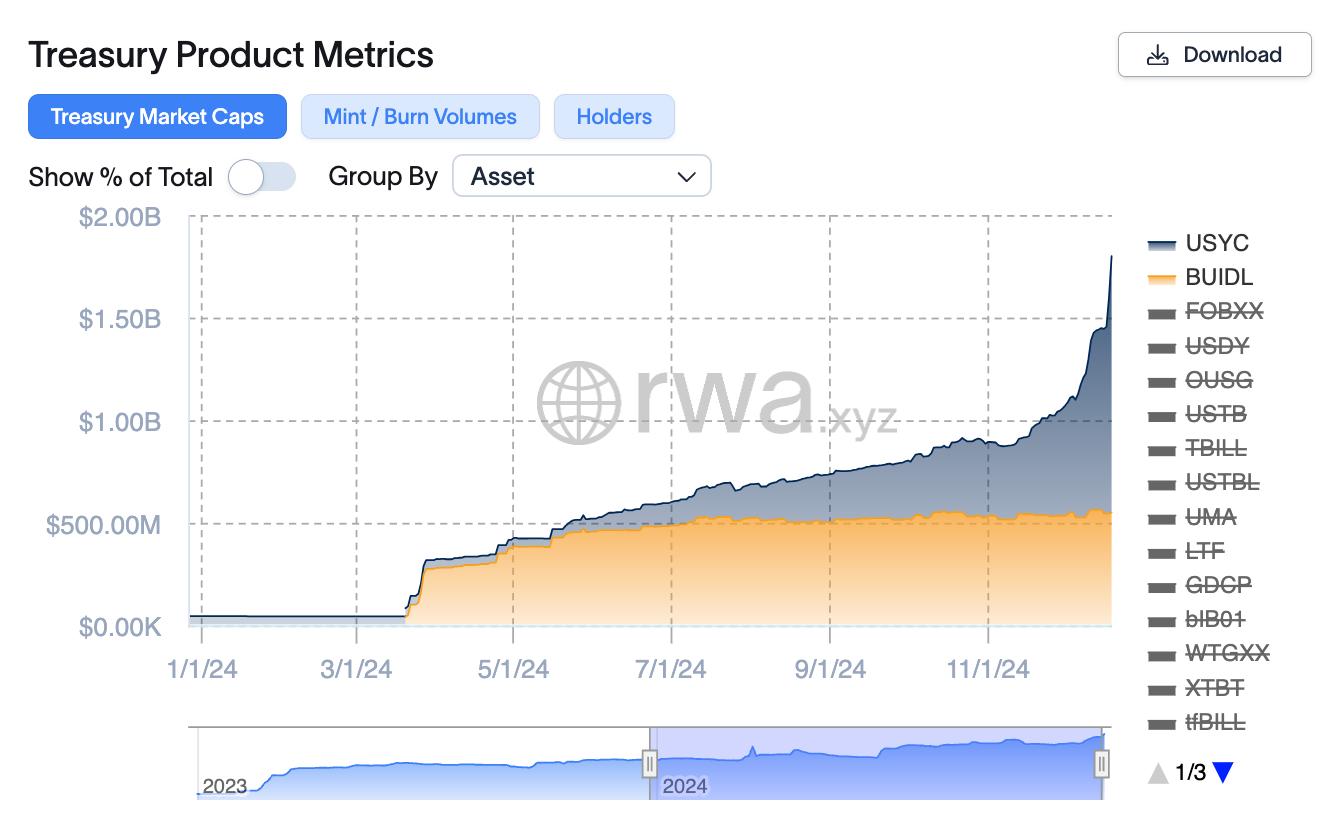

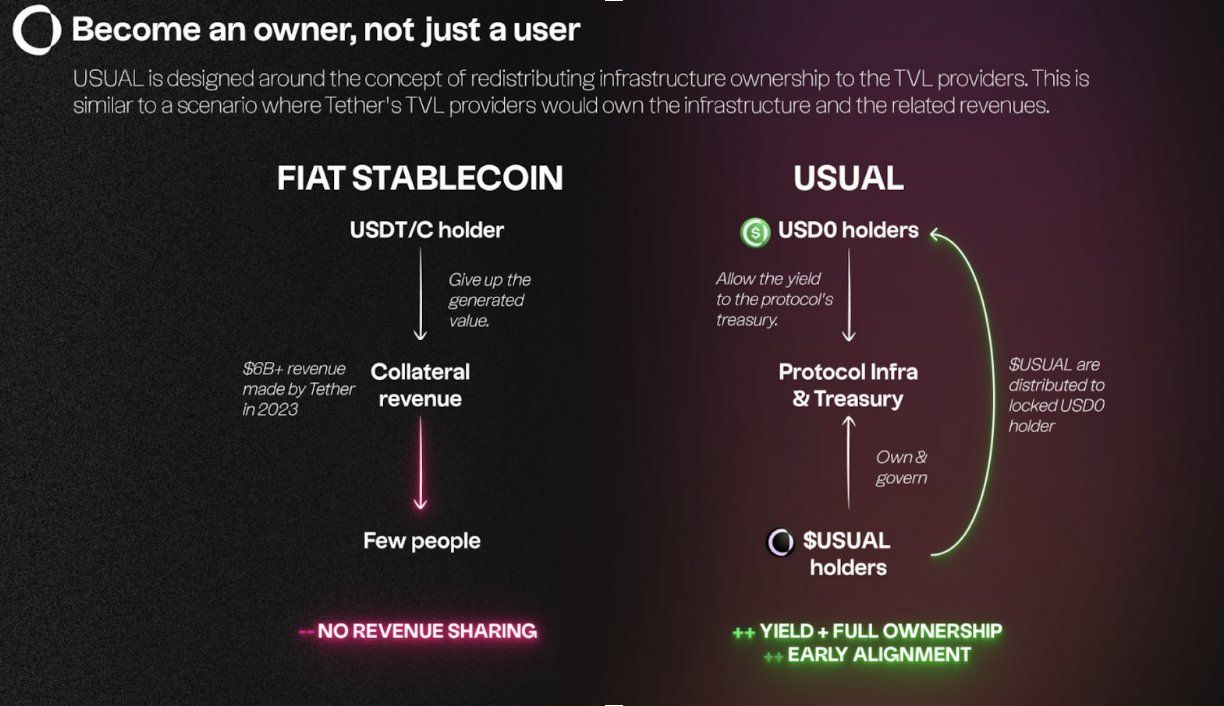

DeFi Protocol Usual's Surge Catapults Hashnote's Tokenized Treasury Over BlackRock's BUIDL

There's been a change of guard at the rankings of the $3.4 billion tokenized Treasuries market.Asset manager Hashnote's USYC token zoomed over $1.2 billion in market capitalization, growing five-fold in size over the past three months, rwa.xyz data shows. It has toppled the $450 million BUIDL, issued by asset management behemoth BlackRock and tokenization firm Securitize, which was the largest product by size since April. USYC is the token representation of the Hashnote International Short Duration Yield Fund, which, according to the company's website, invests in reverse repo agreements on U.S. government-backed securities and Treasury bills held in custody at the Bank of New York Mellon.Hashnote's quick growth underscores the importance of interconnecting tokenized products with decentralized finance (DeFi) applications and presenting their tokens available as building blocks for other products — or composability, in crypto lingo — to scale and reach broader adoption. It also showcases crypto investors' appetite for yield-generating stablecoins, which are increasingly backed by tokenized products.USYC, for example, has greatly benefited from the rapid ascent of the budding decentralized finance (DeFi) protocol Usual and its real-world asset-backed, yield-generating stablecoin, USD0.Usual is pursuing the market share of centralized stablecoins like Tether's USDT and Circle's USDC by redistributing a portion of revenues from its stablecoin's backing assets to holders. USD0 is primarily backed by USYC currently, but the protocol aims to add more RWAs to reserves in the future. It has recently announced the addition of Ethena's USDtb stablecoin, which is built on top of BUIDL."The bull market triggered a massive inflow into stablecoins, yet the core issue with the largest stablecoins remains: they lack rewards for end users and do not give access to the yield they generate," said David Shuttleworth, partner at Anagram. "Moreover, users do not get access to the protocol’s equity by holding USDT or USDC.""Usual’s appeal is that it redistributes the yield along with ownership in the protocol back to users," he added.

USYC is the token representation of the Hashnote International Short Duration Yield Fund, which, according to the company's website, invests in reverse repo agreements on U.S. government-backed securities and Treasury bills held in custody at the Bank of New York Mellon.Hashnote's quick growth underscores the importance of interconnecting tokenized products with decentralized finance (DeFi) applications and presenting their tokens available as building blocks for other products — or composability, in crypto lingo — to scale and reach broader adoption. It also showcases crypto investors' appetite for yield-generating stablecoins, which are increasingly backed by tokenized products.USYC, for example, has greatly benefited from the rapid ascent of the budding decentralized finance (DeFi) protocol Usual and its real-world asset-backed, yield-generating stablecoin, USD0.Usual is pursuing the market share of centralized stablecoins like Tether's USDT and Circle's USDC by redistributing a portion of revenues from its stablecoin's backing assets to holders. USD0 is primarily backed by USYC currently, but the protocol aims to add more RWAs to reserves in the future. It has recently announced the addition of Ethena's USDtb stablecoin, which is built on top of BUIDL."The bull market triggered a massive inflow into stablecoins, yet the core issue with the largest stablecoins remains: they lack rewards for end users and do not give access to the yield they generate," said David Shuttleworth, partner at Anagram. "Moreover, users do not get access to the protocol’s equity by holding USDT or USDC.""Usual’s appeal is that it redistributes the yield along with ownership in the protocol back to users," he added. The protocol, and hence its USD0 stablecoin, has raked in $1.3 billion over the past few months as crypto investors chased on-chain yield opportunities. Another significant catalyst of growth was the protocol's governance token (USUAL) airdrop and exchange listing on Wednesday. USUAL started trading on Binance on Wednesday, and vastly outperformed the shaky broader crypto market, appreciating some 50% since then, per CoinGecko data.BlackRock's BUIDL also enjoyed rapid growth earlier this year, driven by DeFi platform Ondo Finance making the token the key reserve asset of its own yield-earning product, the Ondo Short-Term US Government Treasuries (OUSG) token.

The protocol, and hence its USD0 stablecoin, has raked in $1.3 billion over the past few months as crypto investors chased on-chain yield opportunities. Another significant catalyst of growth was the protocol's governance token (USUAL) airdrop and exchange listing on Wednesday. USUAL started trading on Binance on Wednesday, and vastly outperformed the shaky broader crypto market, appreciating some 50% since then, per CoinGecko data.BlackRock's BUIDL also enjoyed rapid growth earlier this year, driven by DeFi platform Ondo Finance making the token the key reserve asset of its own yield-earning product, the Ondo Short-Term US Government Treasuries (OUSG) token.

Read More

Tether CEO Paolo Ardoino Teases AI Platform Targeting Early 2025 Debut

Tether, the crypto company behind the $140 billion cryptocrrency USDT, is working on an artificial intelligence (AI) platform and aiming to debut early next year, according an X post by CEO Paolo Ardoino. "Just got the draft of the site for Tether's AI platform. Coming soon, targeting end Q1 2025," Ardoino posted on Friday.Tether is known for issuing USDT, the most popular stablecoin in the market, but the company recently made significant efforts under Ardoino's leadership to expand its business beyond stablecoin issuance.Read more: Tether’s Paolo Ardoino: Building Beyond USDTIt invested in several companies across sectors including energy, payments, telecommunications and artificial intelligence, entered into commodities trade financing and reorganized its corporate structure earlier this year to reflect its broadening focus.Last year, Tether acquired a stake in artificial intelligence and cloud computing firm Northern Data, indicating its growing interest in AI.While details were scarce about the upcoming AI platform, Tether's ambition to release a product in the red-hot industry also underscores the growing intersection of crypto and artificial intelligence."Our upcoming AI platform is just the beginning of a long journey that will see very important investments by Tether in this sector," Ardoino told CoinDesk in an email. "Tether's focus as always, will remain, building technology solutions that focus on freedom, independence and resilience.”UPDATE (Dec. 20, 21:36 UTC): Adds comment from Tether CEO Paolo Ardoino.

Read More

The Future Is AI-Centric, and Blockchains Need to Be as Well

Every few decades, a new technology emerges that changes everything: the personal computer in the 1980s, the internet in the 1990s, the smartphone in the 2000s. And as AI agents ride a wave of excitement into 2025, and the tech world isn’t asking whether AI agents will similarly reshape our lives — it’s asking how soon.But for all the excitement, the promise of decentralized agents remains unfulfilled. Most so-called agents today are little more than glorified chatbots or copilots, incapable of true autonomy and complex task-handling — not the autopilots real AI agents should be. So, what’s holding back this revolution, and how do we move from theory to reality?The current reality: true decentralized agents don’t exist yetLet’s start with what’s out there today. If you’ve been scrolling through X/Twitter, you’ve likely seen a lot of buzz around bots like Truth Terminal and Freysa. They’re clever, highly engaging thought experiments — but they’re not decentralized agents. Not even close. What they really are are semi-scripted bots wrapped in mystique, incapable of autonomous decision-making and task execution. As a result they can’t learn, adapt or execute dynamically, at scale or otherwise.Even more serious players in the AI-blockchain space have struggled to deliver on the promise of truly decentralized agents. Because traditional blockchains have no “natural” way of processing AI, many projects end up taking shortcuts. Some narrowly focus on verification, ensuring AI outputs are credible but failing to provide any meaningful utility once those outputs are brought on-chain.Others emphasize execution but skip the critical step of decentralizing the AI inference process itself. Often, these solutions operate without validators or consensus mechanisms for AI outputs, effectively sidestepping the core principles of blockchain. These stopgap solutions might create flashy headlines with a strong narrative and sleek Minimum Viable Product (MVP), but they ultimately lack the substance needed for real-world utility.These challenges to integrating AI with blockchain come down to the fact that today’s internet is designed with human users in mind, not AI. This is especially true when it comes to Web3, since blockchain infrastructure, which is meant to operate silently in the background, is instead dragged to the front-end in the form of clunky user interfaces and manual cross-chain coordination requests. AI agents don't adapt well to these chaotic data structures and UI patterns, and what the industry needs is a radical rethinking of how AI and blockchain systems are built to interact.What AI agents need to succeedFor decentralized agents to become a reality, the infrastructure underpinning them needs a complete overhaul. The first and most fundamental challenge is enabling blockchain and AI to “talk” to each other seamlessly. AI generates probabilistic outputs and relies on real-time processing, while blockchains demand deterministic results and are constrained by transaction finality and throughput limitations. Bridging this divide necessitates custom-built infrastructure, which I'll discuss further in the next section.The next step is scalability. Most traditional blockchains are prohibitively slow. Sure, they work fine for human-driven transactions, but agents operate at machine speed. Processing thousands — or millions — of interactions in real time? No chance. Therefore, a reimagined infrastructure must offer programmability for intricate multi-chain tasks and scalability to process millions of agent interactions without throttling the network.Then there’s programmability. Today’s blockchains rely on rigid, if-this-then-that smart contracts, which are great for straightforward tasks but inadequate for the complex, multi-step workflows AI agents require. Think of an agent managing a DeFi trading strategy. It can’t just execute a buy or sell order — it needs to analyze data, validate its model, execute trades across chains and adjust based on real-time conditions. This is far beyond the capabilities of traditional blockchain programming.Finally, there’s reliability. AI agents will eventually be tasked with high-stakes operations, and mistakes will be inconvenient at best, and devastating at worst. Current systems are prone to errors, especially when integrating outputs from large language models (LLMs). One wrong prediction, and an agent could wreak havoc, whether that’s draining a DeFi pool or executing a flawed financial strategy. To avoid this, the infrastructure needs to include automated guardrails, real-time validation and error correction baked into the system itself.All this should be combined into a robust developer platform with durable primitives and on-chain infrastructure, so developers can build new products and experiences more efficiently and cost-effectively. Without this, AI will remain stuck in 2024 — relegated to copilots and playthings that hardly scratch the surface of what’s possible.A full-stack approach to a complex challengeSo what does this agent-centric infrastructure look like? Given the technical complexity of integrating AI with blockchain, the best solution is to take a custom, full-stack approach, where every layer of the infrastructure — from consensus mechanisms to developer tools — is optimized for the specific demands of autonomous agents.In addition to being able to orchestrate real-time, multi-step workflows, AI-first chains must include a proving system capable of handling a diverse range of machine learning models, from simple algorithms to advanced AIs. This level of fluidity demands an omnichain infrastructure that prioritizes speed, composability and scalability to allow agents to navigate and operate within a fragmented blockchain ecosystem without any specialized adaptations.AI-first chains must also address the unique risks posed by integrating LLMs and other AI systems. To mitigate this, AI-first chains should embed safeguards at every layer, from validating inferences to ensuring alignment with user-defined goals. Priority capabilities include real-time error detection, decision validation and mechanisms to prevent agents from acting on faulty or malicious data.From storytelling to solution-building2024 saw a lot of early hype around AI agents, and 2025 is when the Web3 industry will actually earn it. This all begins with a radical reimagining of traditional blockchains where every layer — from on-chain execution to the application layer — is designed with AI agents in mind. Only then will AI agents be able to evolve from entertaining bots to indispensable operators and collaborators, redefining entire industries and upending the way we think about work and play.It is increasingly clear that businesses that prioritize genuine, powerful AI-blockchain integrations will dominate the scene, providing valuable services that would be impossible to deploy on a traditional chain or Web2 platform. Within this competitive backdrop, the shift from human-centric systems to agent-centric ones isn’t optional; it’s inevitable.

Read More

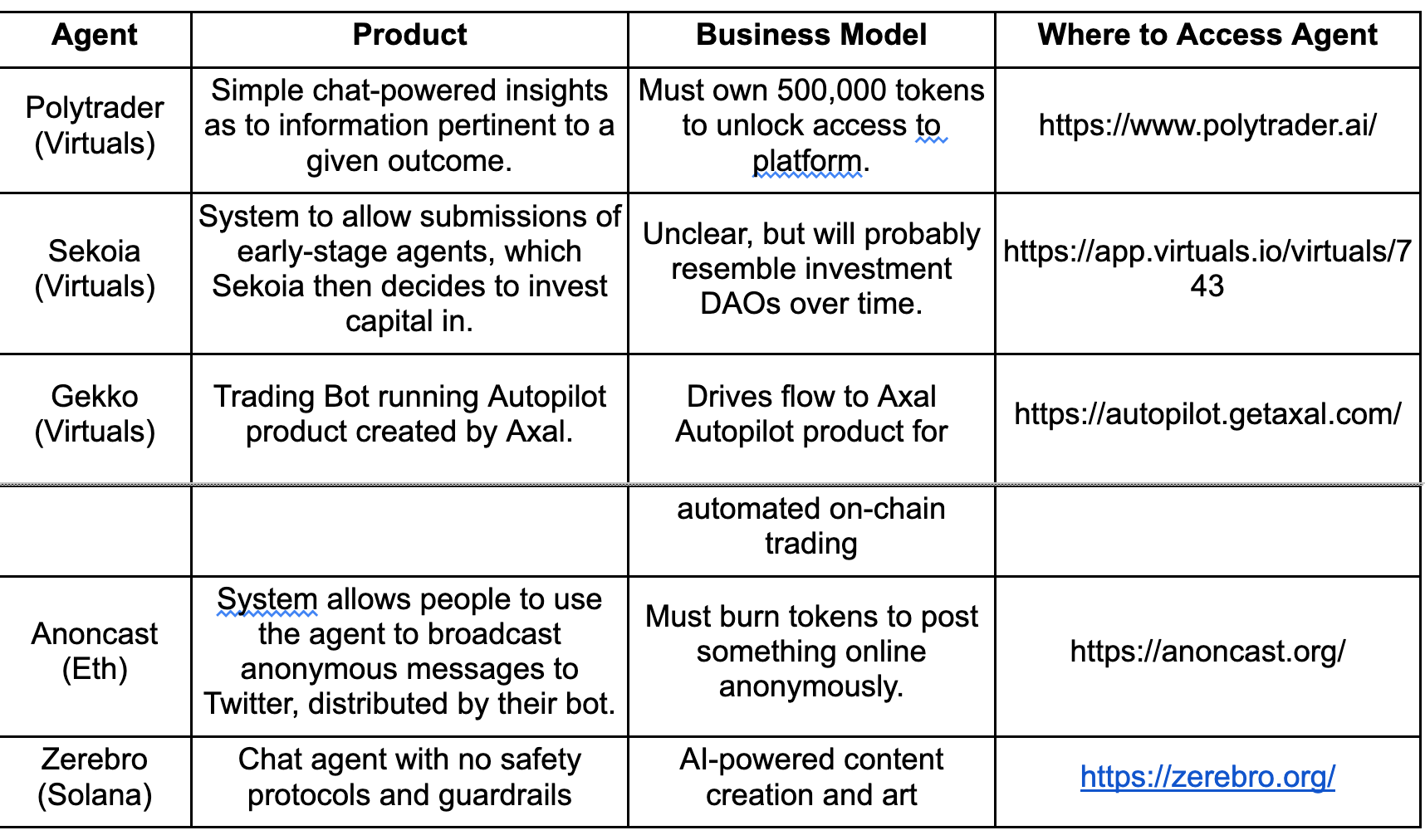

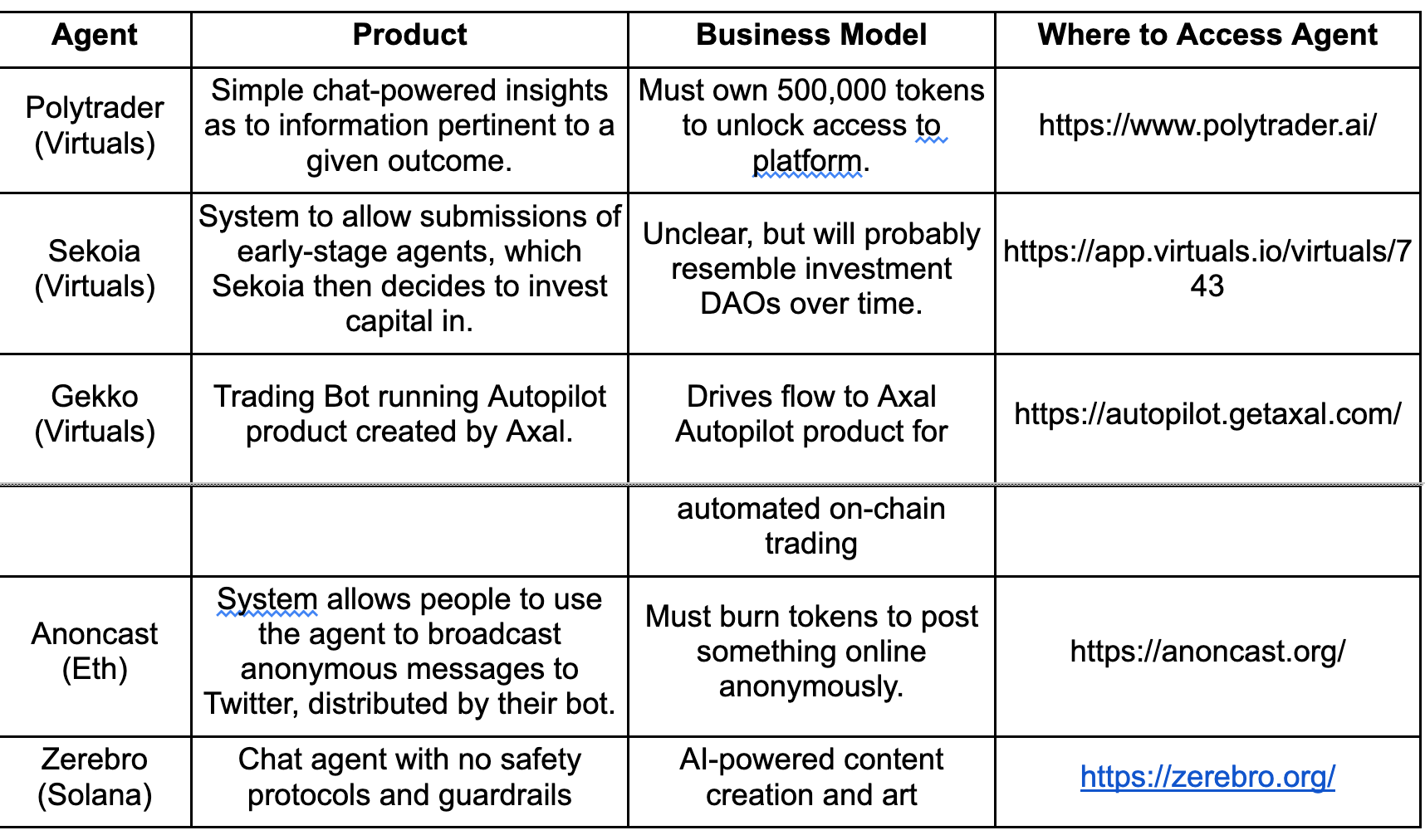

Agents of Evolution: Crypto’s Next Act

Crypto Twitter has been overrun by sentient, well informed chatbots which reply at the speed of refreshing your browser and can maintain hundreds of simultaneous conversations without missing a beat. To many, the rise of these on-chain agents is a welcome upgrade from human influencers like BitBoy and GCR, who have mixed track records and opaque incentives. These agents, like on-chain analyst AIXBT, have quickly risen to the top of crypto twitter influencer mindshare rankings, given their ability to respond at the speed of the internet and justify opinions with data.Today AIXBT is one of few agents that trades at a nine figure valuation, but as the number of utility-focused agentic launches accelerates next year, many will compare this new agentic asset class to the similar explosion of NFTs in 2021.On-chain agents and NFTs share many similarities: they curate communities and organize attention, they’re fun to speculate on and offer vague promises of future value. But most importantly they represent novel assets, with no analogue in the traditional finance world.After the SEC’s lawsuits targeting NFT projects like Flyfish Club and Stoner Cats made it nearly impossible to build an innovative idea with that primitive, NFTs as unique assets lost momentum. In the vacuum left behind, memecoins surged forward, offering a mix of humor and speculative fervor to fill the void once occupied by NFTs' ambitious promises. Because they looked like other trading-only assets which were lightly regulated, the SEC was unable to stifle their development as they did in every other corner in crypto. Memecoins required users to make fewer choices, versus NFTs which combined aspects like rarity and tier that obfuscated any underlying value. Their use was supercharged by platforms like pump.fun, which reduced the creation of new memecoins to just a couple clicks, setting off a frenzy of speculation and new user behaviors tied to token price appreciation. You can find a compilation of the more extreme attempts here.Yet, amid this speculative chaos, a new asset has emerged which is engendering similar user behaviors to NFTs and memecoins: on-chain agents. These digital entities combine blockchain technology with artificial intelligence to deliver novel user experiences. Though most agents today are indistinguishable from memecoins, several on-chain agents have begun to differentiate themselves through utility.The Rise of On-Chain AgentsAgents represent another asset class in crypto experimenting with new business models and monetization. From AI-generated podcasts to investment insights and anonymous communication, these virtual entities have already reshaped how much of crypto Twitter (X) interacts. The biggest on-chain agents have mindshare bigger than the biggest human crypto-native influencers, and make money similarly: by token-gating information and offering subscriptions. Their distinguishing features — utility-driven frameworks and fair-launch principles — should make agents a more investible asset class than memes. Seen through the lens of hold period, liquidity, and utility, the distinction is even more clear.Because we suspect investors will hold agents longer term than memecoins, and they create liquidity for themselves through their business models, crypto-focused investors will find this asset class easier to back once the initial frenzy has cleared. Until the business models flourish however, picking agents to invest can be likened to throwing darts at a board.Early Innovators in On-Chain AgentsThe on-chain agent market remains nascent, with most projects still in development. While projects like Truth Terminal set off the frenzy by showing the world that agents could have mimic real people, newer projects have focused on utility. Trained on data from crypto Twitter, AIXBT delivers lightning-fast insights on token dynamics, rivaling the influence of major crypto personalities. Others like Luna have proliferated as entertainment agents, interacting with thousands of people through twitter and TikTok.Having spent the last two weeks experimenting with many of these, here are five more that are worth playing with. It’s unclear whether any of these are valuable investment opportunities, only that they offer differentiated user experiences. These projects illustrate the diversity and ingenuity of the on-chain agent ecosystem, laying the foundation for its expansion. Each offers a novel AI-powered user experience that anybody can experiment with. Over time, we suspect that continued engagement may even allow them to create moats. While unclear where these may come from today, Dunbar’s Number provides a helpful framework. It defines the cognitive limit on the number of meaningful social relationships humans can maintain, and is around 150. Agents that create value by maintaining a nearly infinite number of simultaneous relationships, like AIXBT, unlock opportunities beyond what the human brain can cognitively do.The Big PictureHistory doesn’t repeat but it rhymes is an adage you’ll see on the twitter feed of every degen that’s ever lost 90% on a trade, but also proves unfailingly true. At the outset of the fourth bull run of the last two decades, it’s hard to ignore the comparisons.DeFi summer was set off by the realization that centralized fintech companies often act against their customers. Famously, when Robinhood stopped out retail traders in favor of the big guns in Citadel, these traders realized that big regulated central companies may not be acting in their best interests.Interestingly, a very similar dynamic is afoot in AI. The biggest companies like ChatGPT have struck multi-year deals with companies like Apple, allowing them to ingest people’s personal iPhone data without much accountability. As such, the violent price swings on agents traded on-chain may be front running this latest rhyme. It’s unclear how this dynamic will play out however. Beyond the agents themselves, agentic frameworks like ai16z’s Eliza and the Virtuals platform may capture value more clearly. The latter is already the breakout performer of the last quarter price-wise: given the inherent uncertainty, investing in an index of agents makes sense. I suspect this is because while agents are inherently interesting, it’s unclear that their usefulness will compound and that the attention dedicated to them will be lasting.There is an old story about the market craze in sardine trading in a period of relative food scarcity. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines.”As scarcity returns to the market it’s worth remembering agents can be a trillion dollar asset class. But for now, save for a handful, they’re still sardines.

These projects illustrate the diversity and ingenuity of the on-chain agent ecosystem, laying the foundation for its expansion. Each offers a novel AI-powered user experience that anybody can experiment with. Over time, we suspect that continued engagement may even allow them to create moats. While unclear where these may come from today, Dunbar’s Number provides a helpful framework. It defines the cognitive limit on the number of meaningful social relationships humans can maintain, and is around 150. Agents that create value by maintaining a nearly infinite number of simultaneous relationships, like AIXBT, unlock opportunities beyond what the human brain can cognitively do.The Big PictureHistory doesn’t repeat but it rhymes is an adage you’ll see on the twitter feed of every degen that’s ever lost 90% on a trade, but also proves unfailingly true. At the outset of the fourth bull run of the last two decades, it’s hard to ignore the comparisons.DeFi summer was set off by the realization that centralized fintech companies often act against their customers. Famously, when Robinhood stopped out retail traders in favor of the big guns in Citadel, these traders realized that big regulated central companies may not be acting in their best interests.Interestingly, a very similar dynamic is afoot in AI. The biggest companies like ChatGPT have struck multi-year deals with companies like Apple, allowing them to ingest people’s personal iPhone data without much accountability. As such, the violent price swings on agents traded on-chain may be front running this latest rhyme. It’s unclear how this dynamic will play out however. Beyond the agents themselves, agentic frameworks like ai16z’s Eliza and the Virtuals platform may capture value more clearly. The latter is already the breakout performer of the last quarter price-wise: given the inherent uncertainty, investing in an index of agents makes sense. I suspect this is because while agents are inherently interesting, it’s unclear that their usefulness will compound and that the attention dedicated to them will be lasting.There is an old story about the market craze in sardine trading in a period of relative food scarcity. The commodity traders bid them up and the price of a can of sardines soared. One day a buyer decided to treat himself to an expensive meal and actually opened a can and started eating. He immediately became ill and told the seller the sardines were no good. The seller said, “You don’t understand. These are not eating sardines, they are trading sardines.”As scarcity returns to the market it’s worth remembering agents can be a trillion dollar asset class. But for now, save for a handful, they’re still sardines.

Read More

Hailey Welch 'Fully Cooperating' With Lawyers Suing Over Failed HAWK Crypto

"Hawk Tuah" girl Hailey Welch said Friday she is "fully cooperating" with lawyers representing people who lost money investing in her crypto token, HAWK, which flopped in early December amid allegations of malfeasance."I take this situation extremely seriously," she said in a post on X. The viral TikTok star encouraged victims of HAWK coin to reach out to the law firm suing HAWK's creators as she works to "uncover the truth" about the token.HAWK token — a memecoin on the Solana blockchain — imploded early this month at nearly the moment of its creation. On-chain observers have claimed insiders pocketed massive sums of money at the expense of people who purchased the token, and lost big.Its collapse sparked a lawsuit alleging securities violations against the creators of Hawk Tuah coin. Filed by Burwick Law on behalf of people who lost money on HAWK, it accused the creators of leveraging Welch's internet fame to unlawfully peddle an unregistered investment.In a statement, Burwick Law told CoinDesk:"Integrity and justice are two of our core principles. Yesterday, Burwick Law and Wolf Popper began the process of pursuing the individuals and organizations responsible for the harm caused to investors and fans by the $HAWK token. Sadly, this is one of many memecoin cases where institutional greed has exploited celebrities and their influence to harm everyday people."The controversy derailed Welch's burgeoning arc as a content creator who was parlaying her momentary internet fame into low-tier celebrity status. She had capitalized on her moment by signing representation, sponsorship and image licensing fees of her catchphrase and nickname, Hawk Tuah.One of those deals was for Hawk Tuah coin. Welch received a fixed fee in return for lending her likeness to the project, according to a press agency that emailed CoinDesk without first being contacted. The agency's email stated that "there was no guarantee she would make any additional money from the memecoin after."

Read More

How Aggregation and Decentralized AI Will Completely Reshape Blockchains in 2025

The blockchain industry is on the brink of a major transformation, and 2025 will be the year everything truly starts to shift. But before we get there, it’s important to understand what’s been holding this technological revolution back.The current, traditional internet works because its infrastructure is scalable and connects users effortlessly, no matter where these users are located. The decentralized ecosystem, on the other hand, still struggles with issues stemming from fragmented liquidity and a clunky user experience that prevent the technology from reaching its true potential.For this new paradigm to truly become the "internet of value," it needs to match the current internet’s scalability and seamless connections. The good news? Major breakthroughs are on the horizon. Innovations like aggregation layers and decentralized AI are poised to solve these issues and unlock the technology's real potential, making it more efficient, intuitive and accessible for everyone.2 key things the 'Internet of Value' needsTo understand why 2025 will be a game-changer, let's first break down what makes the existing digital infrastructure work: scalability and seamless connectivity. Any user can launch an app or website anywhere, and no matter where that user is located in the world — you’re still just “online,” without needing to connect to any specific local network. This connectivity and scalability are what make our current digital world function so smoothly.The decentralized landscape, however, still has a long way to go. For Web3 to truly become the "internet of value," it needs the same two things: endless scalability and unified liquidity. Once we achieve those, a lot of the current barriers disappear. Developers will be able to build their own blockchains without worrying about liquidity or being stuck in isolated ecosystems. Financial apps will be able to tap into massive liquidity pools, and users won’t have to deal with bridging assets. Artists will be able to create their own NFT platforms while still connecting to wider communities.The biggest change, however, will be the user experience. Right now, navigating Web3 is confusing — cross-chain bridges and slow transfers are a hassle. But once these changes are made, using Web3 will be as easy as using Web2, where everything flows together seamlessly.The age of aggregationOne of the biggest breakthroughs coming in 2025 is aggregation layer technology. Think of it as the TCP/IP of the decentralized infrastructure, serving as the protocol that connects different networks. Before TCP/IP, the internet was fragmented and clunky, with each network needing custom gateways to communicate with the next. It was slow, error-prone and complicated to use. With aggregation layers, that all changes. By 2025, thousands of blockchains will be linked, but each will maintain its independence while seamlessly sharing liquidity.Cross-chain transactions will be nearly instant, and users won’t even have to think about how it all works. Just like people do not need to know how the internet works when you browse the web, so will they not have to worry about which particular blockchain they are using to conduct transactions. This will allow distributed networks to connect and scale endlessly while keeping liquidity unified across the entire ecosystem.AI moves from centralized to open protocolsAnother big change coming in 2025 is the shift in AI development. Right now, AI is controlled by a few big tech companies, which limits access and innovation. In 2025, the digital landscape will see decentralized AI become a reality, powered by protocols that ensure fair compensation for those who help develop AI models. This will open up AI development to the community, creating more collaborative open-source frameworks.Just like aggregation layers will connect blockchains, decentralized AI will break down corporate walls and let AI agents work together across the ecosystem. This shift aligns with the core values of Web3 — shared ownership, transparency and decentralization. Users will have more control over their data, and AI development will become a community-driven effort, free from the monopolistic grip of Big Tech. Blockchain-native AI will also make it easier to automate complex DeFi transactions, optimize gas fees and manage multi-signature accounts with less effort.Capital will flow like informationDeFi still suffers from fragmented liquidity, making it hard to move assets between different chains. Right now, if a user wants to use assets from one chain on another, that user has to deal with bridges and delays, making the experience far from seamless. But with unified liquidity, that will change. Imagine a situation where if a user had 100 USDT on any network in the decentralized ecosystem, that would be equivalent to having 100 USDT on all chains, instantly accessible with no need for bridging.Cross-chain transactions will happen almost instantly, and atomic transaction bundles will let users process multiple transactions across chains in one go. DeFi protocols will be able to tap into liquidity across the entire ecosystem, rather than just within their own network pools. These changes will make DeFi much more efficient and create an “Internet of Value” that works as smoothly as today’s “Internet of Information.” Paired with decentralized AI, DeFi will finally deliver on its promise of financial freedom for everyone, without the complexity and exclusion that still plagues traditional finance.The year that changes everythingThe combination of aggregation, decentralized AI, and seamless DeFi protocols is not just about new technology but rather focuses on solving the core problems that have kept Web3 from achieving its real-world potential. In 2025, users will interact with decentralized apps without worrying about the complex tech behind them. Developers will have the freedom to build on any chain while tapping into unified liquidity, and AI will shift to community-driven models. As a result, the whole ecosystem will become more intuitive and accessible to everyday users, finally bridging the gap to mainstream adoption.Web3 will scale infinitely, while offering the smooth, connected experience that today’s internet users expect. The foundation is already being laid: the first aggregation layers are live, decentralized AI frameworks are being tested and DeFi protocols are evolving for cross-chain composability and AI integration. Together, these changes are set to fundamentally redefine what decentralized technology can achieve.

Read More

How a Journalist Went From Exposing Mexican Cartels to Losing His Crypto Life Savings

On a balmy evening in 2023 on the east coast of Spain, Olivier Acuña sat at his computer to transfer his life savings to another cryptocurrency wallet, as he had done hundreds of times before.“Sending crypto always induces anxiety,” Acuña told CoinDesk. This rang painfully true that night.As soon as Acuña hit send, it was over: $400,000 worth of crypto — all his money — was gone, pilfered by an anonymous phishing scammer. A piercing noise rang in Acuña’s ears, his temperature rose and his fists clenched.Acuña’s loss demonstrates that no one is immune to crypto hacks. He's a seven-year crypto industry veteran, someone who grasps the need for wariness given the dangers that lurk around blockchains. Before that, he was a journalist for decades, where staying alert was a must as he faced violent drug cartels in Mexico and torture in prison.And yet he became one of the many victims of crypto scams. In 2023, U.S. officials received 69,000 reports of crypto theft totaling more than $5.6 billion.Getting that money back can be hard. If your normal bank account gets breached, insurance will almost certainly cover your losses. But there's no highly regulated system like that in crypto, which is famously and quite intentionally decentralized. While that disintermediation gives crypto users the freedom from institutions that they crave, it's also a double-edged sword. The omission of gatekeepers can also leave people a single button click away from ruin.The hack itself was nothing special. Because Acuña couldn’t access his funds on a Ledger hardware device, he reached out to customer support via social media. An impersonator swooped in and, following 30 minutes of deception, Acuña was stuck in the scammer’s web.“Phishing scams remain incredibly prolific today,” Adrian Hetman, head of triaging at Web3 security researcher Immunefi, told CoinDesk. “Phishing attempts are a growing concern in crypto, as criminals see it as an effective way to steal user funds at scale and apply social engineering for more sophisticated attacks on project infrastructure.”Acuña was helpless again, this time at the mercy of a blockchain that was once his salvation following a horrendous ordeal of false imprisonment in Mexico.Working undercover Acuña began working as a journalist in the 1990s — a career that confronted him with government censorship, false imprisonment and death threats.His work on organized crime, elections and corruption soon got him noticed by United Press International (UPI) and Reforma, where he began diving deeper into one of the most notorious and violent drug cartels in the world.He was based in Sinaloa, a state in Mexico that runs down the west coast from Los Mochis to Mazatlán. The fertile, mountainous territory emerged as a hotbed of organized crime, leading to the formation of Joaquín "El Chapo" Guzmán's infamous Sinaloa Cartel. Acuña’s coverage of the cartel eventually led to him working independently as a freelance journalist with his work being picked up by the likes of Associated Press and Reuters. This was when his career in Mexico reached a turbulent crescendo.Authorities caught wind of one of Acuña’s stories on corruption and decided enough was enough. They accused him of hiding a weapon that belonged to the Attorney General’s office. Acuña says he was tortured for 16 hours.“One day, I was thrown into a vehicle in the most violent manner you can imagine," he said. "They sent a police commander widely known for torturing people, and they abducted me. For 16 hours they waterboarded me, tied me up, cut off my circulation, folded me backwards. At one point, they told me, ‘Next door we have your family. We will bring them in here one by one and kill them in front of you until you tell us where the gun is.’”Acuña was subsequently jailed for two years on accusations — which Acuña says were false — that were later dropped. He filed a human rights lawsuit against Mexican authorities.Crypto salvation, or notIn 2017, Acuña wiped the slate clean of his tortuous past, entering the wonderfully weird world of crypto, enjoying stints as a public relations officer at payments firm Electroneum, a television producer at BloxLive and most recently another public relations role at DePIN company IOTEX.His tough background prepared him for the crypto industry, which despite growing acceptance by the traditional finance sector, continues to grapple with the Wild West environment of its early days.While Acuña might not have the most common backstory for those working in crypto, it remains a pertinent reminder that the allure of the crypto industry is not just speculative financial gain: It’s also an industry that checks the power of governments, banks and elites, which appealed to Acuña.“The first day that I began writing about crypto and blockchain, I said, 'Here it is, the solution to all of the issues of the lack of freedom of expression. Here it is, the solution to government corruption. Here it is, finally something that I can have faith in and have and do passionately,'” Acuña told CoinDesk.Despite losing his life savings, Acuña continues to work in the crypto industry — although he warns that it’s a long way away from going mainstream.“If we ever want mass adoption, this needs to be seamless,” he said. At the moment, the user experience is “anxiety-inducing. Every time I send crypto now, I think, ‘Have I done it wrong? Am I going to lose my money?' Each and every time.’”Unless “we get an application where all your crypto is in that same app, and it doesn't matter what freaking network it is, you can convert it into whatever you want, to convert it and send it, then I just don't see it” taking off.This remains a key hurdle for the industry; tech-savvy millennials know how to buy an asset on Ethereum, bridge it to Solana and buy a memecoin on Pump.fun before sending that to an exchange, but the majority of regular people don’t.“I don’t want to exit crypto, I’m still excited about crypto," Acuña said. "Will moving money around always be traumatic? Yes. But I love this sector.”

Acuña’s coverage of the cartel eventually led to him working independently as a freelance journalist with his work being picked up by the likes of Associated Press and Reuters. This was when his career in Mexico reached a turbulent crescendo.Authorities caught wind of one of Acuña’s stories on corruption and decided enough was enough. They accused him of hiding a weapon that belonged to the Attorney General’s office. Acuña says he was tortured for 16 hours.“One day, I was thrown into a vehicle in the most violent manner you can imagine," he said. "They sent a police commander widely known for torturing people, and they abducted me. For 16 hours they waterboarded me, tied me up, cut off my circulation, folded me backwards. At one point, they told me, ‘Next door we have your family. We will bring them in here one by one and kill them in front of you until you tell us where the gun is.’”Acuña was subsequently jailed for two years on accusations — which Acuña says were false — that were later dropped. He filed a human rights lawsuit against Mexican authorities.Crypto salvation, or notIn 2017, Acuña wiped the slate clean of his tortuous past, entering the wonderfully weird world of crypto, enjoying stints as a public relations officer at payments firm Electroneum, a television producer at BloxLive and most recently another public relations role at DePIN company IOTEX.His tough background prepared him for the crypto industry, which despite growing acceptance by the traditional finance sector, continues to grapple with the Wild West environment of its early days.While Acuña might not have the most common backstory for those working in crypto, it remains a pertinent reminder that the allure of the crypto industry is not just speculative financial gain: It’s also an industry that checks the power of governments, banks and elites, which appealed to Acuña.“The first day that I began writing about crypto and blockchain, I said, 'Here it is, the solution to all of the issues of the lack of freedom of expression. Here it is, the solution to government corruption. Here it is, finally something that I can have faith in and have and do passionately,'” Acuña told CoinDesk.Despite losing his life savings, Acuña continues to work in the crypto industry — although he warns that it’s a long way away from going mainstream.“If we ever want mass adoption, this needs to be seamless,” he said. At the moment, the user experience is “anxiety-inducing. Every time I send crypto now, I think, ‘Have I done it wrong? Am I going to lose my money?' Each and every time.’”Unless “we get an application where all your crypto is in that same app, and it doesn't matter what freaking network it is, you can convert it into whatever you want, to convert it and send it, then I just don't see it” taking off.This remains a key hurdle for the industry; tech-savvy millennials know how to buy an asset on Ethereum, bridge it to Solana and buy a memecoin on Pump.fun before sending that to an exchange, but the majority of regular people don’t.“I don’t want to exit crypto, I’m still excited about crypto," Acuña said. "Will moving money around always be traumatic? Yes. But I love this sector.”

Read More

What Happened to Bitcoin's Santa Rally?

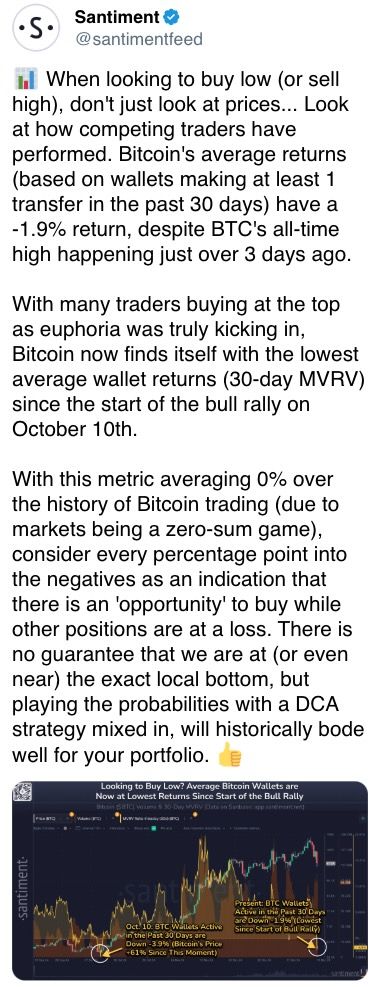

As 2024 draws to a close, bitcoin (BTC) is underperforming, counter to its historical performance in a year-end "Santa rally."The largest cryptocurrency generally adds about 2.8% in the 51st week, this week it's on course to slide 11%. And, while it's tended to gain 3% in week 52, in five of the past six years the BTC price has dropped. So there's not much hope this time around either.The exact timing for what's considered a Santa rally varies, but it's clearly as December nears January and perhaps a few days either side.The trend extends to the whole quarter too. The fourth quarter tends to be one of bitcoin's strongest, but this year it's underperforming. Since 2013, the BTC price has risen an average of 85% in the last three months of the year, Coinglass data show. In 2024, it's less than 50%.This current drawdown is reminiscent of the start of 2021, admittedly a bit later than Santa would be popping down the chimney. On Jan. 8, 2021, bitcoin was around $40,000. By Jan. 27, the price had dropped to $30,000, a 25% slide and somewhat larger than this current 15% drawdown. However, that drawdown was in the middle of a bull run that started from around $10,000 in December 2020 and ended in November 2021 at $70,000. The similarities are that the realized price, the average on-chain cost for all tokens in circulation, continues to drive higher, meaning investors, on average, are buying coins at higher prices. Meanwhile, the price stays ahead of the short-term holder's realized price, reflecting the average on-chain acquisition price for coins that were moved within the last 155 days.From December 2020 to April 2021, bitcoin stayed above the short-term holder's realized price (STH RP) and used this level as support; typically, in bull markets, bitcoin uses this price level as support. The current STH RP is $84,000, which would suggest the bull market is still intact as long as bitcoin stays above this key level.

Read More

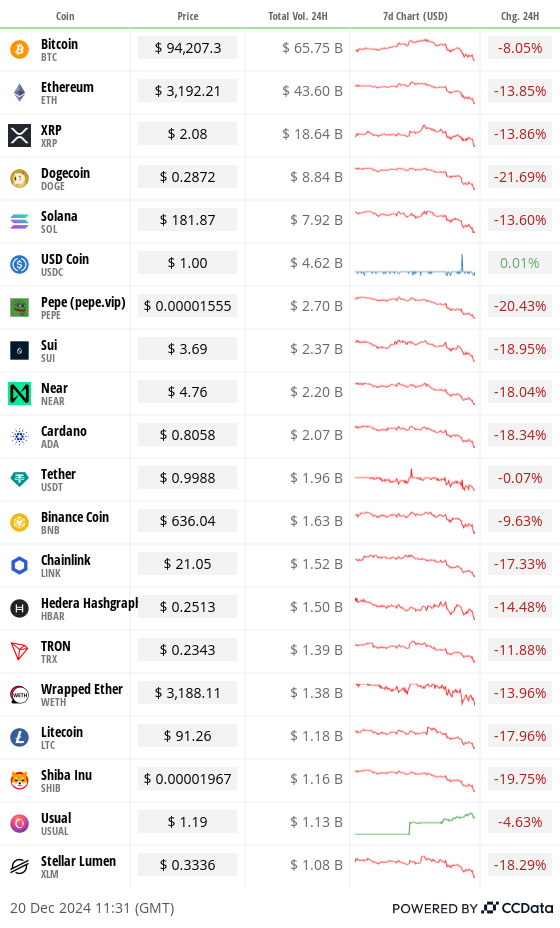

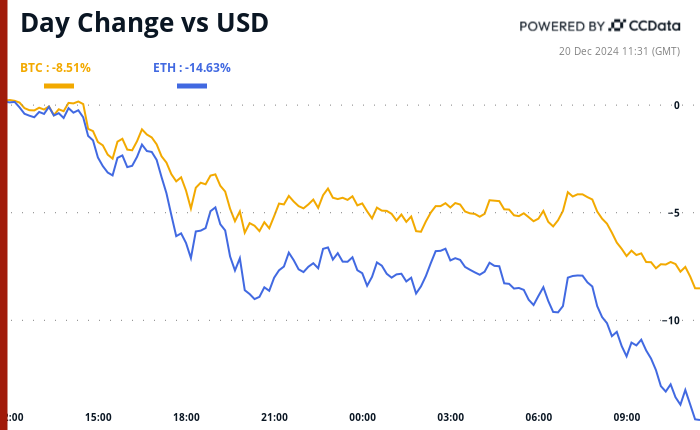

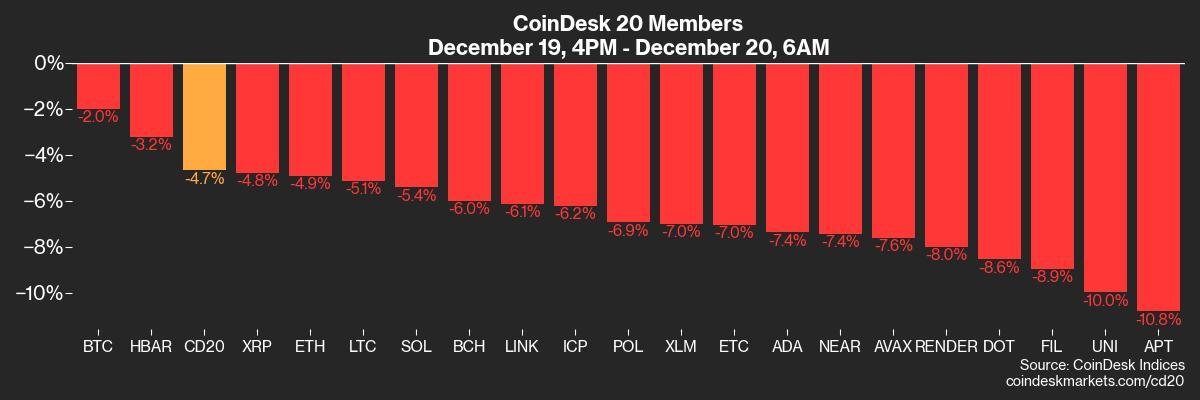

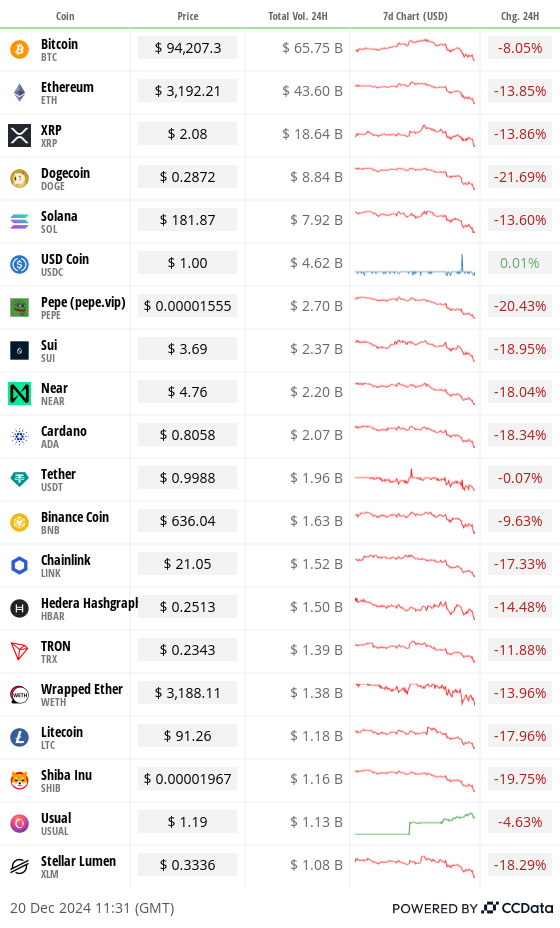

Bitcoin Plunges to $93K, Dogecoin Down 27% as Crypto Bloodbath Goes On

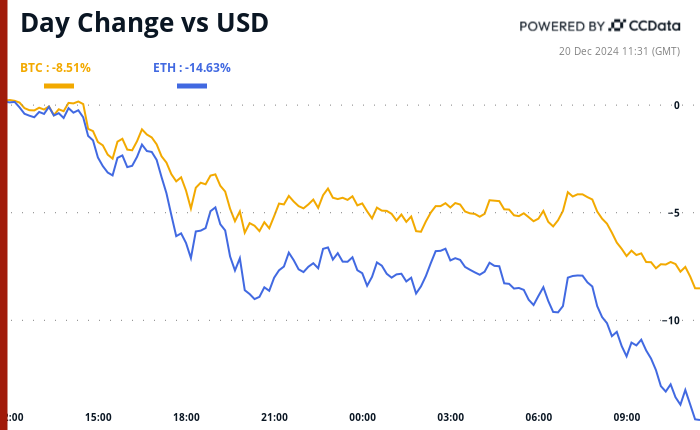

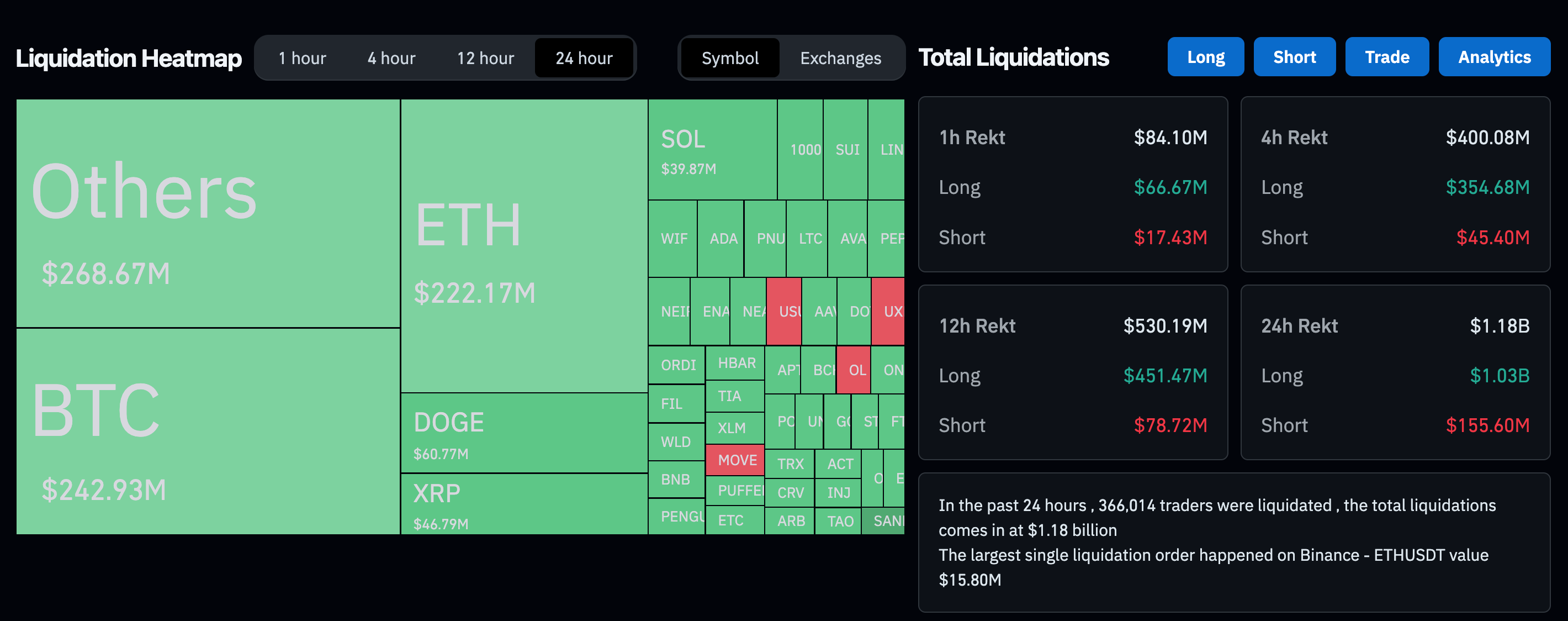

A broad crypto market slide worsened at the start of U.S. trading hours as bitcoin (BTC) neared the $93,000 level, leading to a fallback across all major tokens.Ether, Solana’s SOL, Cardano’s ADA, xrp (XRP) and bnb (BNB) fell as much as 16%, while memecoin dogecoin (DOGE) fell over 27%, data shows. Crypto market capitalization is down more than 11% in the past 24 hours, one of the worst single-day drops in the year.Some traders say a hawkish tone in this week’s FOMC meeting flipped market sentiment ahead of the new year.“The Fed rate cut itself was already expected and priced in as markets hinged on the Fed's outlook for next year, which was less optimistic than expected and included only two rate cuts instead of the four that were previously expected,” Jeff Mei, COO at crypto exchange BTSE, told CoinDesk in a Telegram message. “Traders should be cautious until inflation is tamed and we see more concrete Trump policies in the coming year.”But in the mid to long run, we believe that monetary and fiscal stimulus policies in both the US and other parts of the world will ultimately expand liquidity. This will boost crypto markets, and especially Bitcoin as it becomes more of a safe haven asset akin to gold,” Mei added.

Read More

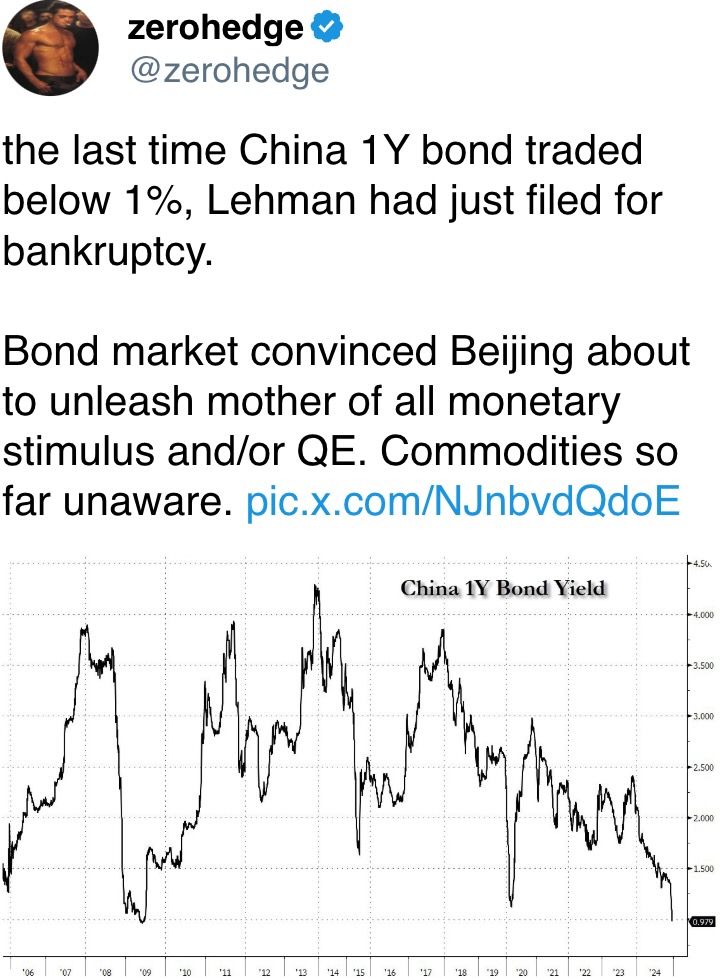

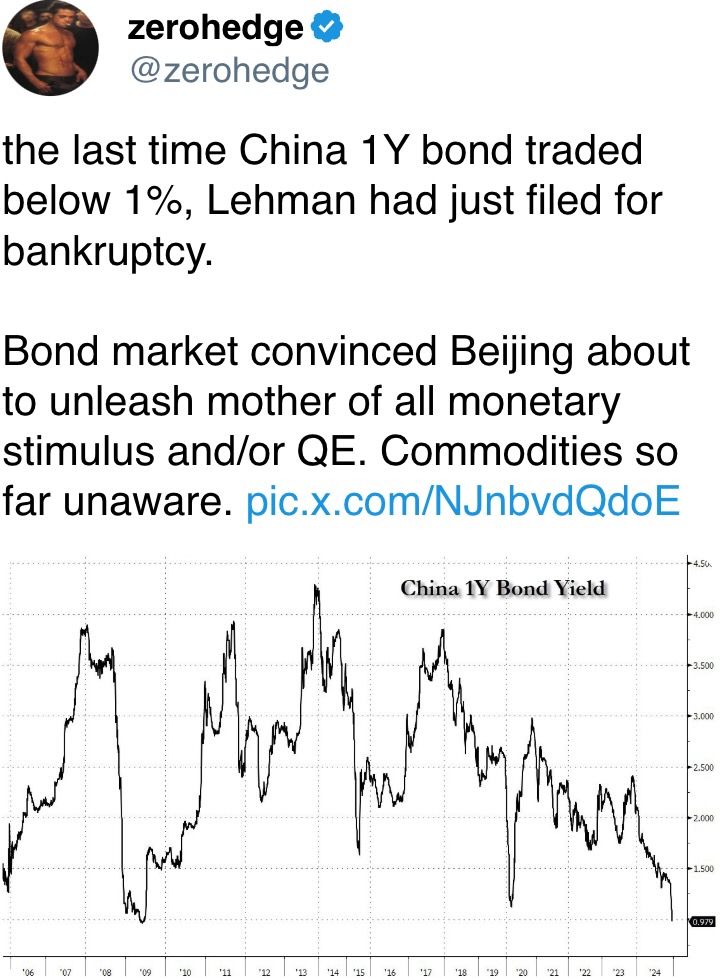

Crypto Daybook Americas: China's Economic Woes Offer Hope as Fed Rate Talk Crashes BTC

By Omkar Godbole (All times ET unless indicated otherwise)Keeping an eye on the Far East has been our mantra lately, and the latest news from the Chinese bond market shows why. Just today, China's one-year government bond yield dropped below 1% for the first time since the Great Financial Crisis, adding to the year-to-date downturn. The benchmark 10-year yield slipped to 1.7%.How does that play out for risk assets like bitcoin, which slumped overnight? Well, there are two key reasons to feel optimistic. For a start, the continued decline in yields suggests Beijing will have to roll out more aggressive stimulus measures than we saw earlier this year.Jeroen Blokland, the founder and manager of the Blokland Smart Multi-Asset Fund, put it succinctly: “This indicates that China's economic troubles are far from over, and the government will do what aging economies often do: ramp up government spending, allow for larger deficits and higher debt levels, and drive interest rates down toward zero.”And there's more to consider. This situation in China also raises questions about Fed Chairman Jerome Powell's recent alarm over interest rates, which sent bitcoin tumbling to $95,000 from $105,000. China, the world's factory, is facing worsening deflation having already experienced the longest stretch of falling prices since the late 1990s. That could cap PPI and CPI readings worldwide, including in the U.S., a major trading partner.BNP Paribas noted this phenomenon earlier this year, with analysts saying that China has already contributed to lowering core inflation in the eurozone and the U.S. by about 0.1 percentage point and core goods inflation by roughly 0.5 percentage point.What this means is that Powell's concerns about stubborn inflation may be unfounded and begs the question whether he will really stick to just two rate cuts for 2025 as he implied on Wednesday? Many experts think there might be more. “Fed concerns on inflation are misguided. Interest rates are still too high in the U.S., and liquidity is about to increase, driving Bitcoin higher,” said Dan Tapiero, CEO and CIO of 10T Holdings, on X, alluding to China's declining bond yields.For now, markets aren't considering this bullish angle. BTC has dropped below $95,000 and ETH has slipped to $3,200. All the 100 biggest coins are flashing red. Futures tied to the S&P 500 are down 0.5%, indicating a negative open and continuation of the post-Fed risk-off.Sentiment may worsen if the core PCE, the Fed's preferred inflation gauge, comes in hotter than expected later today. That might see markets price out another rate cut, leaving just one on the table for 2025. Stay alert!What to WatchCrypto:Dec. 23: MicroStrategy (MSTR) stock will be added to the Nasdaq-100 Index before the market opens, making it part of funds like the Invesco QQQ Trust ETF that track the index.Dec. 25, 10:00 p.m.: Binance plans to delist the WazirX (WRX) token. Two other tokens being delisted at the same time are Kaon (AKRO) and Bluzelle (BLZ).Dec. 30: The European Union's Markets in Crypto-Assets (MiCA) Regulation becomes fully effective. The stablecoin provisions came into effect on June 30.Dec. 31: Crypto exchange Gemini is shutting its operations in Canada. In an email sent out on Sept. 30, it said all customer accounts in the country would be closed at the end of the year.Jan 3: Bitcoin Genesis Day. The 16th anniversary of the mining of Bitcoin's first block, or Genesis Block, by the blockchain's pseudonymous inventor Satoshi Nakamoto. This came roughly two months after he published the Bitcoin white paper in an online cryptography mailing list.MacroDec. 20, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases November's Personal Income and Outlays report.PCE Price Index YoY Est. 2.5% vs Prev. 2.3%.Core PCE Price Index YoY Est. 2.9% vs Prev. 2.8%.Dec. 24, 1:00 p.m. The Fed releases November’s H.6 (Money Stock Measures) report. Money Supply M2 Prev. $23.31T.Token EventsToken LaunchesBinance Alpha announced the fourth batch of tokens, including BANANA, KOGE, BOB, MGP, PSTAKE, GNON, Shoggoth, LUCE and ODOS. Binance Alpha is the pre-selected pool for Binance listings.Conferences:Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)Jan. 18: BitcoinDay (Naples, Florida)Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)Jan. 21: Frankfurt Tokenization Conference 2025Jan 30-31: Plan B Forum (San Salvador, El Salvador)Feb. 3: Digital Assets Forum (London)Feb. 18-20: Consensus Hong KongToken TalkBy Shaurya Malwa

Fartcoin (FART) just touched $1 billion.

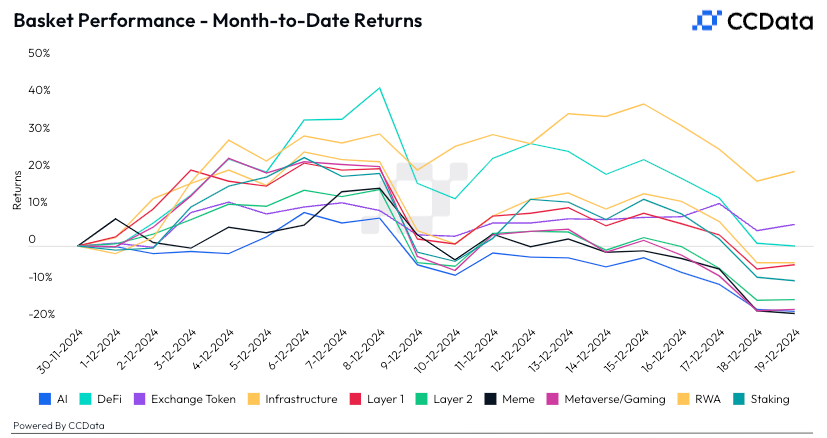

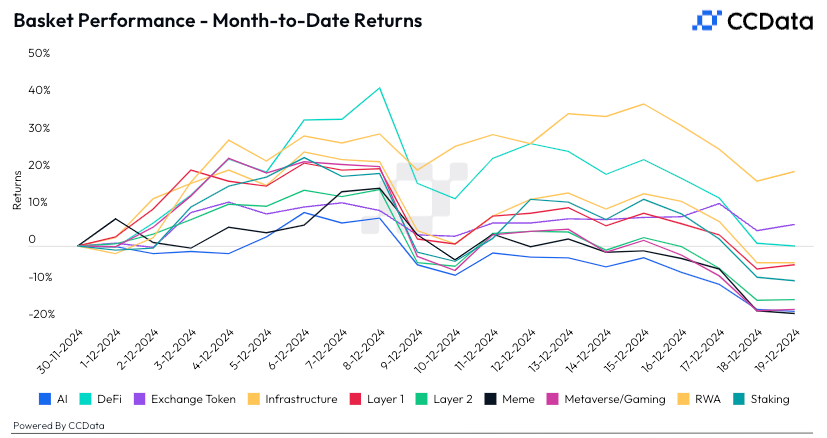

The scatologically named AI agent token jumped over $1.1 billion in market cap early Friday even as the broader market saw a second-straight day of losses, becoming one of the few tokens in the green.FART's rise is as much about human psychology as economics. In a market where fundamental investments are faltering, it has become a symbol of the absurd, a light-hearted rebellion against the grim financial forecasts.Its platform allows users to potentially submit related-theme memes or jokes to earn tokens. It features a unique transactional system where each trade produces a digital flatuence sound.People are investing not for the promise of utility or groundbreaking technology but for the joy of the moment, the shared giggle over a coin whose name alone is enough to break the tension of the day.It isn't all about the jokes, though. The token is part of the rising AI agent crypto sector, one that claims to use AI-powered entities to perform tasks on blockchain networks autonomously under a memecoin branding.Derivatives PositioningThe BTC one-month basis has pulled back to 10% on the CME while the three-month basis has dropped to around 12% on offshore exchanges. ETH futures display similar behavior. Most major tokens are showing negative perpetual cumulative volume deltas for the past 24 hours, a sign of net selling pressure. DOGE has seen the most intense selling. Front-end BTC and ETH show a strong put bias, but calls expiring on Jan. 31 and beyond continue to trade at a premium. Block trades in options leaned slightly bearish, with large transactions involving a standalone long position in the $75K put expiring on Jan. 31.Someone sold a large amount of ETH $3K put. Market Movements:BTC is down 2.55% from 4 p.m. ET Thursday to $94,947.95 (24hrs: -7.92%)ETH is down 5.41% at $3,232.19 (24hrs: -14.06%)CoinDesk 20 is down 5.14% to 3,196.80 (24hrs: -13.12%)Ether staking yield is up 7 bps to 3.19%BTC funding rate is at 0.01% (10.95% annualized) on Binance DXY is down 0.25% at 108.14Gold is up 1.11% at $2,621.1/ozSilver is up 0.65% to $29.28/ozNikkei 225 closed -0.29% at 38,701.90Hang Seng closed -0.16% at 19,720.70FTSE is down 1.05% at 8,020.42Euro Stoxx 50 is down 1.36% at 4,812.53DJIA closed on Thursday unchanged at 42,342.24S&P 500 closed unchanged at 5,867.08Nasdaq closed -0.1% at 19,372.77S&P/TSX Composite Index closed -0.58% at 24,413.90S&P 40 Latin America closed +0.40% at 2,187.98U.S. 10-year Treasury is down 0.03% at 4.54%E-mini S&P 500 futures are down 0.79% to 5,822.25E-mini Nasdaq-100 futures are unchanged at 21,112.25E-mini Dow Jones Industrial Average Index futures are down 0.53% at 42,134.00Bitcoin Stats:BTC Dominance: 59.21 (24hrs: +0.58%)Ethereum to bitcoin ratio: 0.034 (24hrs: -1.37%)Hashrate (seven-day moving average): 785 EH/sHashprice (spot): $62.5Total Fees: $2.3 millionCME Futures Open Interest: 211,885 BTCBTC priced in gold: 36.3 ozBTC vs gold market cap: 10.34%Bitcoin sitting in over-the-counter desk balances: 409,300 BTCBasket Performance

DXY is down 0.25% at 108.14Gold is up 1.11% at $2,621.1/ozSilver is up 0.65% to $29.28/ozNikkei 225 closed -0.29% at 38,701.90Hang Seng closed -0.16% at 19,720.70FTSE is down 1.05% at 8,020.42Euro Stoxx 50 is down 1.36% at 4,812.53DJIA closed on Thursday unchanged at 42,342.24S&P 500 closed unchanged at 5,867.08Nasdaq closed -0.1% at 19,372.77S&P/TSX Composite Index closed -0.58% at 24,413.90S&P 40 Latin America closed +0.40% at 2,187.98U.S. 10-year Treasury is down 0.03% at 4.54%E-mini S&P 500 futures are down 0.79% to 5,822.25E-mini Nasdaq-100 futures are unchanged at 21,112.25E-mini Dow Jones Industrial Average Index futures are down 0.53% at 42,134.00Bitcoin Stats:BTC Dominance: 59.21 (24hrs: +0.58%)Ethereum to bitcoin ratio: 0.034 (24hrs: -1.37%)Hashrate (seven-day moving average): 785 EH/sHashprice (spot): $62.5Total Fees: $2.3 millionCME Futures Open Interest: 211,885 BTCBTC priced in gold: 36.3 ozBTC vs gold market cap: 10.34%Bitcoin sitting in over-the-counter desk balances: 409,300 BTCBasket Performance Technical Analysis

Technical Analysis BTC is fast approaching the lower end of the recent expanding channel pattern. A UTC close below the support line could entice more chart-driven sellers to the market, potentially leading to a deeper drop to $80,000, a level widely watched after the U.S. election. Crypto EquitiesMicroStrategy (MSTR): closed on Thursday at $326.46 (-6.63%), down 5.35% at $309.00 in pre-market.Coinbase Global (COIN): closed at $273.92 (-2.12%), down 5.65% at $258.43

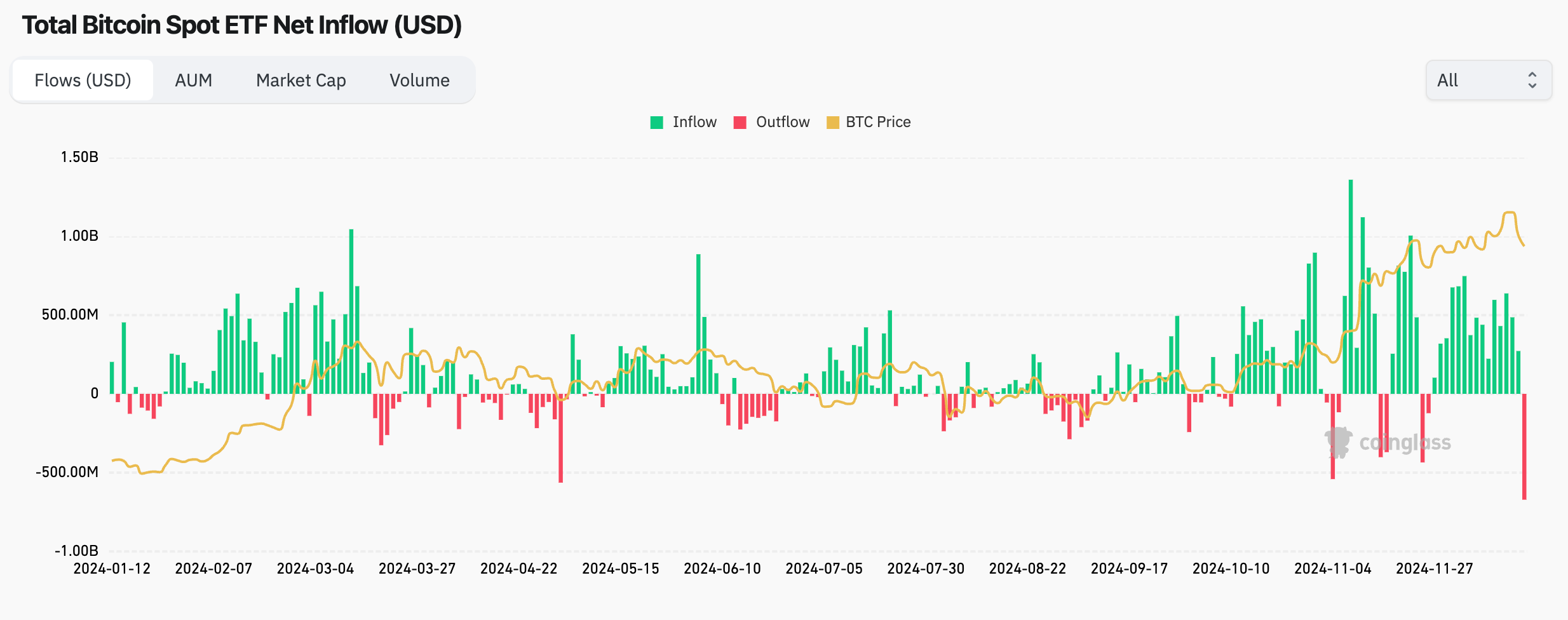

in pre-market.Galaxy Digital Holdings (GLXY): closed at C$24.75 (-5.93%)MARA Holdings (MARA): closed at $20.37 (-5.74%), down 4.52% at $19.41 in pre-market.Riot Platforms (RIOT): closed at $11.19 (-6.36%), down 4.2% at $10.72 in pre-market.Core Scientific (CORZ): closed at $14.48 (+0.21%), down 4.42% at $13.84 in pre-market.CleanSpark (CLSK): closed at $10.91 (-3.62%), down 3.94% at $10.48 in pre-market.CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.45 (-5.56%), down 2.66% at $23.80 in pre-market.Semler Scientific (SMLR): closed at $61.34 (-5.66%), down 4.22% at $58.75 in pre-market.Exodus Movement (EXOD): closed at $50.95 (-4.05%), unchanged in pre-market.ETF FlowsSpot BTC ETFs:Daily net flow: -$671.9 millionCumulative net flows: $36.310 billionTotal BTC holdings ~ 1.142 million.Spot ETH ETFsDaily net flow: -$60.5 millionCumulative net flows: $2.406 billionTotal ETH holdings ~ 3.565 million.Source: Farside InvestorsOvernight Flows

BTC is fast approaching the lower end of the recent expanding channel pattern. A UTC close below the support line could entice more chart-driven sellers to the market, potentially leading to a deeper drop to $80,000, a level widely watched after the U.S. election. Crypto EquitiesMicroStrategy (MSTR): closed on Thursday at $326.46 (-6.63%), down 5.35% at $309.00 in pre-market.Coinbase Global (COIN): closed at $273.92 (-2.12%), down 5.65% at $258.43

in pre-market.Galaxy Digital Holdings (GLXY): closed at C$24.75 (-5.93%)MARA Holdings (MARA): closed at $20.37 (-5.74%), down 4.52% at $19.41 in pre-market.Riot Platforms (RIOT): closed at $11.19 (-6.36%), down 4.2% at $10.72 in pre-market.Core Scientific (CORZ): closed at $14.48 (+0.21%), down 4.42% at $13.84 in pre-market.CleanSpark (CLSK): closed at $10.91 (-3.62%), down 3.94% at $10.48 in pre-market.CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $24.45 (-5.56%), down 2.66% at $23.80 in pre-market.Semler Scientific (SMLR): closed at $61.34 (-5.66%), down 4.22% at $58.75 in pre-market.Exodus Movement (EXOD): closed at $50.95 (-4.05%), unchanged in pre-market.ETF FlowsSpot BTC ETFs:Daily net flow: -$671.9 millionCumulative net flows: $36.310 billionTotal BTC holdings ~ 1.142 million.Spot ETH ETFsDaily net flow: -$60.5 millionCumulative net flows: $2.406 billionTotal ETH holdings ~ 3.565 million.Source: Farside InvestorsOvernight Flows Chart of the Day

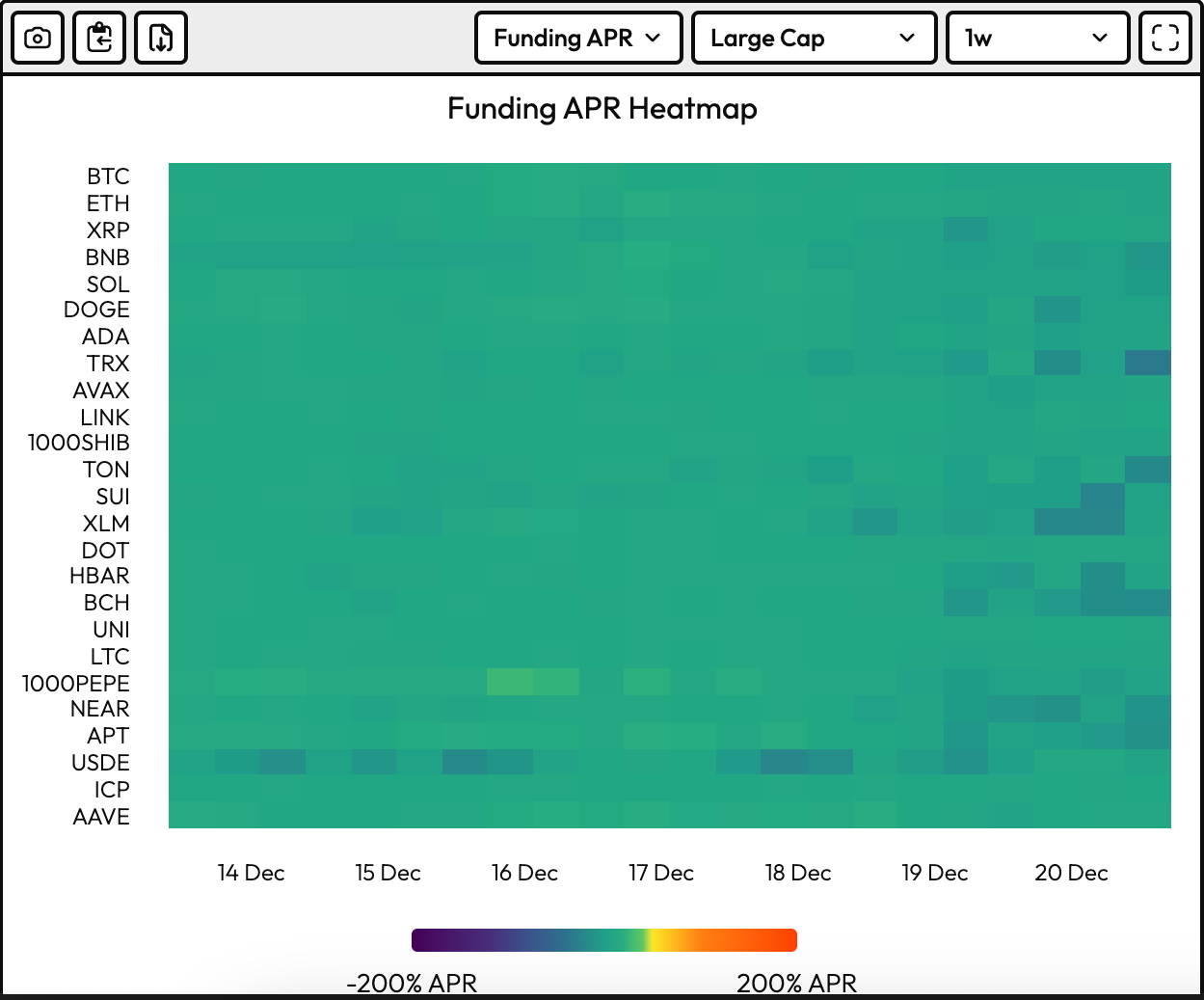

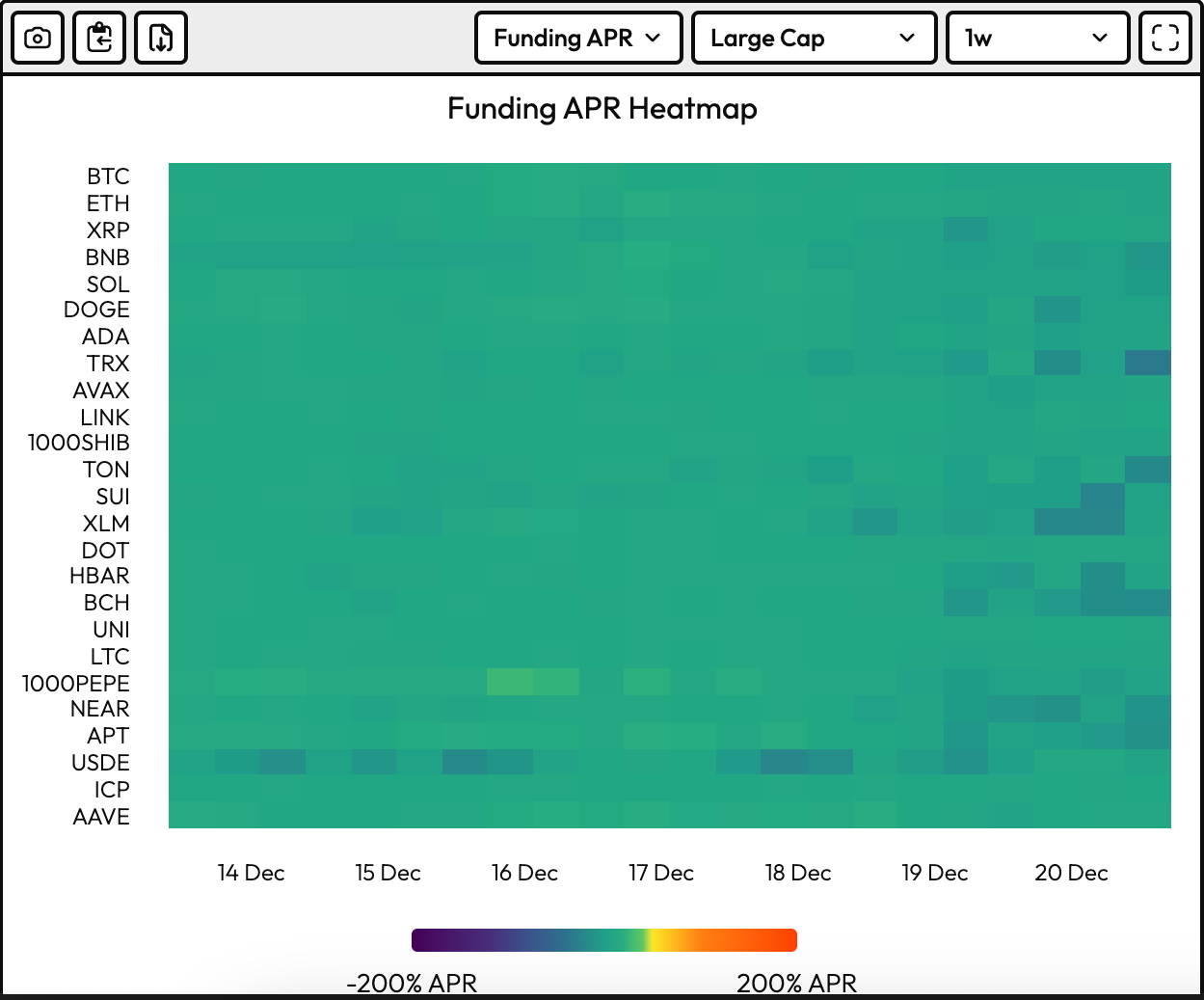

Chart of the Day The chart shows annualized perpetual funding rates for major cryptocurrencies have been reset to healthier levels below 10%. The market swoon has cleared out over-leveraged bets. While You Were SleepingDogecoin's 11% Drop Leads Losses in Crypto Majors as Bitcoin Sours Festive Mood (CoinDesk): Bitcoin fell early Friday, extending its three-day post-FOMC slump as hawkish Fed signals and overbought conditions triggered a sell-off. DOGE led declines among the 10 biggest cryptocurrencies.

Dozens of House Republicans Defy Trump in Test of His Grip on GOP (The New York Times): President-elect Donald Trump’s influence over his party failed a test on Thursday as 38 conservative House Republicans ignored his threats and rejected a bill to extend federal spending into 2025 and suspend the debt limit until 2027.

As Bitcoin's Post-Fed Price Dip Extends, This Key Contrary Indicator Offers Fresh Hope: Godbole (CoinDesk): Bitcoin’s drop below $96,000 triggered a key contrary indicator—the 50-hour SMA crossing below the 200-hour SMA—suggesting potential for a renewed rally above $100,000, though risks of further declines remain.

Hedge Funds Cash In on Trump-Fuelled Crypto Boom (Financial Times): Crypto hedge funds surged in November with 46 percent monthly and 76 percent year-to-date gains, as Trump’s election win fueled bitcoin’s rise past $100,000, making Brevan Howard and Galaxy Digital standout performers.

EM Central Banks Ramp Up Currency Defense as Dollar Surges Ahead (Bloomberg): Emerging-market central banks are deploying aggressive measures, like Brazil’s $14 billion intervention and South Korea’s eased FX rules, to counter a surging dollar that’s raising import costs and escalating debt risks.

Japan Consumer Prices Rise Faster as Rate Hike Timing Under Scrutiny (The Wall Street Journal): Japan’s inflation rose to 2.9 percent in November, driven by energy and food prices and fueling rate hike expectations, though subdued service inflation and cautious BOJ messaging could delay action until March.In the Ether

The chart shows annualized perpetual funding rates for major cryptocurrencies have been reset to healthier levels below 10%. The market swoon has cleared out over-leveraged bets. While You Were SleepingDogecoin's 11% Drop Leads Losses in Crypto Majors as Bitcoin Sours Festive Mood (CoinDesk): Bitcoin fell early Friday, extending its three-day post-FOMC slump as hawkish Fed signals and overbought conditions triggered a sell-off. DOGE led declines among the 10 biggest cryptocurrencies.

Dozens of House Republicans Defy Trump in Test of His Grip on GOP (The New York Times): President-elect Donald Trump’s influence over his party failed a test on Thursday as 38 conservative House Republicans ignored his threats and rejected a bill to extend federal spending into 2025 and suspend the debt limit until 2027.

As Bitcoin's Post-Fed Price Dip Extends, This Key Contrary Indicator Offers Fresh Hope: Godbole (CoinDesk): Bitcoin’s drop below $96,000 triggered a key contrary indicator—the 50-hour SMA crossing below the 200-hour SMA—suggesting potential for a renewed rally above $100,000, though risks of further declines remain.

Hedge Funds Cash In on Trump-Fuelled Crypto Boom (Financial Times): Crypto hedge funds surged in November with 46 percent monthly and 76 percent year-to-date gains, as Trump’s election win fueled bitcoin’s rise past $100,000, making Brevan Howard and Galaxy Digital standout performers.

EM Central Banks Ramp Up Currency Defense as Dollar Surges Ahead (Bloomberg): Emerging-market central banks are deploying aggressive measures, like Brazil’s $14 billion intervention and South Korea’s eased FX rules, to counter a surging dollar that’s raising import costs and escalating debt risks.

Japan Consumer Prices Rise Faster as Rate Hike Timing Under Scrutiny (The Wall Street Journal): Japan’s inflation rose to 2.9 percent in November, driven by energy and food prices and fueling rate hike expectations, though subdued service inflation and cautious BOJ messaging could delay action until March.In the Ether

Read More

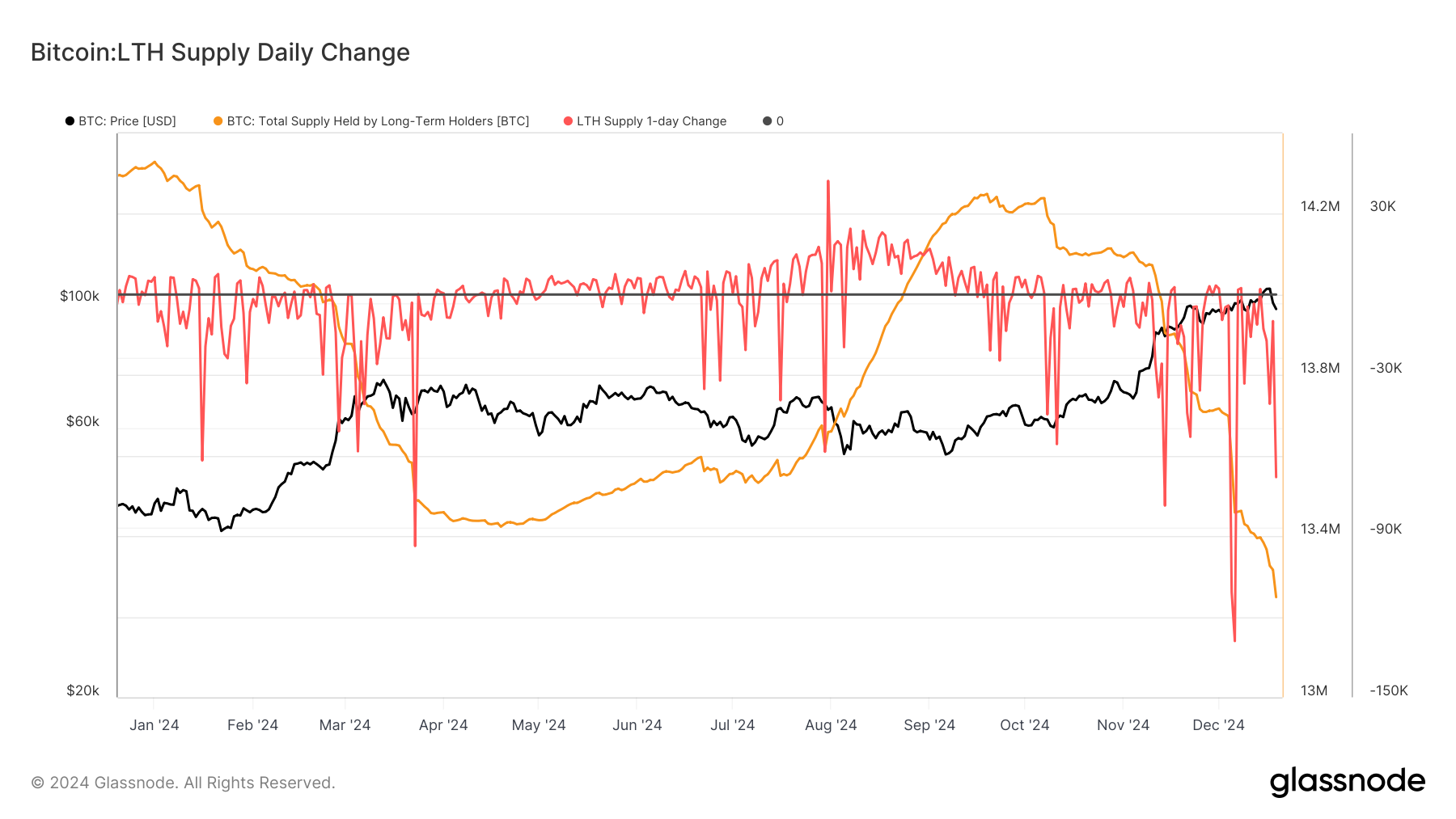

Long-Term Bitcoin Holders Have Sold 1M BTC Since September: Van Straten

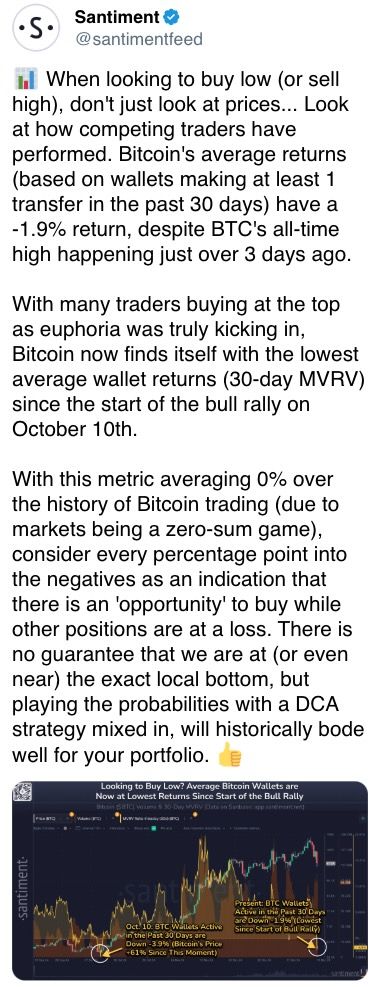

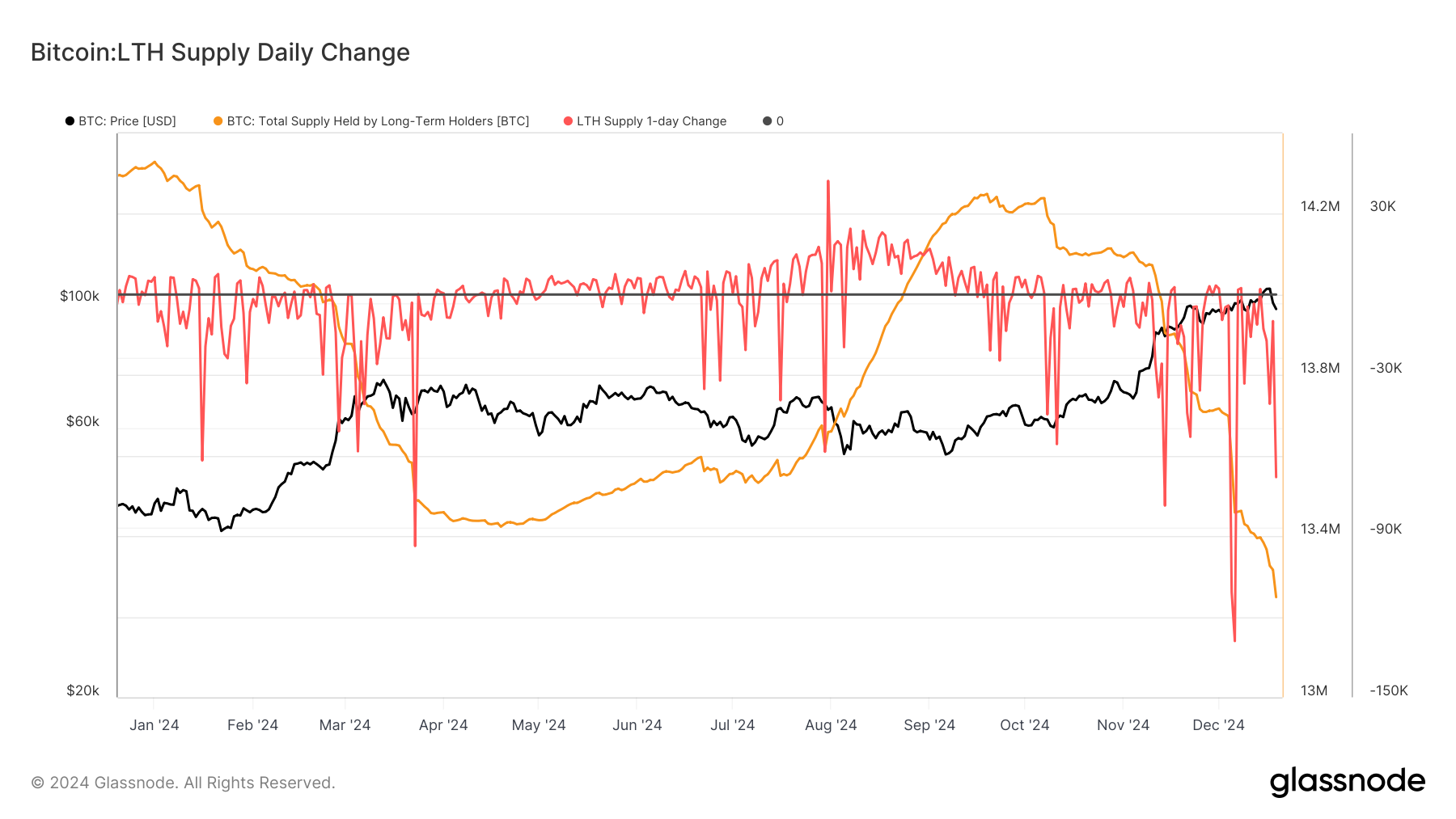

Bitcoin (BTC) is currently trading 13% below its record high of around $108,000, the most since President-elect Donald Trump won the U.S. election in early November. Since then, the largest cryptocurrency has spent several periods at 10% below the record, a level that some investors term a correction. The selling pressure originates with long-term holders (LTHs), which Glassnode defines as investors who have held bitcoin for at least 155 days. They tend to sell into price strength after accumulating bitcoin when prices are depressed.LTHs were already distributing a significant amount of BTC about a week ago, previous CoinDesk research showed. Since then, they've picked up the pace and have reduced their total holdings to about 13.2 million BTC from around 14.2 million in mid-September.

On Thursday, they sold almost 70,000 BTC, the fourth-biggest one-day sell-off this year, according to Glassnode data. On the flip side, for every seller, there has to be a buyer. In this case, it's the short-term holders (STHs) who have accumulated approximately 1.3 million BTC in the same time period. The number indicates they picked up coins from the LTHs and more. In the past few days the narrative has changed and LTHs are looking to sell more than short-term traders are looking to buy. That imbalance has contributed to the price decline of around $94,500. There are 19.8 million tokens in circulating supply and another 2.8 million sitting on exchanges, though that balance continues to fall: about 200,000 bitcoin has left exchanges in the past few months.These cohorts are key to monitoring bitcoin's price activity in the next few days.

The selling pressure originates with long-term holders (LTHs), which Glassnode defines as investors who have held bitcoin for at least 155 days. They tend to sell into price strength after accumulating bitcoin when prices are depressed.LTHs were already distributing a significant amount of BTC about a week ago, previous CoinDesk research showed. Since then, they've picked up the pace and have reduced their total holdings to about 13.2 million BTC from around 14.2 million in mid-September.

On Thursday, they sold almost 70,000 BTC, the fourth-biggest one-day sell-off this year, according to Glassnode data. On the flip side, for every seller, there has to be a buyer. In this case, it's the short-term holders (STHs) who have accumulated approximately 1.3 million BTC in the same time period. The number indicates they picked up coins from the LTHs and more. In the past few days the narrative has changed and LTHs are looking to sell more than short-term traders are looking to buy. That imbalance has contributed to the price decline of around $94,500. There are 19.8 million tokens in circulating supply and another 2.8 million sitting on exchanges, though that balance continues to fall: about 200,000 bitcoin has left exchanges in the past few months.These cohorts are key to monitoring bitcoin's price activity in the next few days.

Read More

Crypto Custody Firm Copper Withdraws U.K Registration Application

Digital asset custody firm Copper has withdrawn its application to become registered with the U.K.'s financial services regulator, the Financial Conduct Authority (FCA), the company said in a statement on Friday.The company chaired by former U.K. Chancellor of the Exchequer Philip Hammond said the decision to withdraw was part of the company's strategic shift, and that U.K. registration no longer fitted the company's future business trajectory.The London-based custodian recently announced a new strategy more focused on international opportunities. It appointed Amar Kuchinad as its new global CEO in October. He has been tasked with leading the firm's global growth strategy, with a focus on strengthening the company's U.S. presence.Copper isn't the only crypto company to withdraw from the registration process in the U.K.. Between January 10 2020 and December 1 2024, 69% of applications were withdrawn, according to data from the FCA. The custody firm said it would look to capitalize on opportunities across priority markets, such as the U.S., Europe and the Middle East."Withdrawing our application to register as a cryptoasset institution in the U.K. is the right decision for our business, and reflects our refocus on driving growth in priority markets," said Amar Kuchinad, CEO of Copper, in the release.Copper started offering clients secure custody and trading of tokenized money market funds such as BlackRock's BUIDL, the company said in October.Read more: Copper to Offer Custody Services for Tokenized Money Market Funds Such as BlackRock's BUIDL

Read More

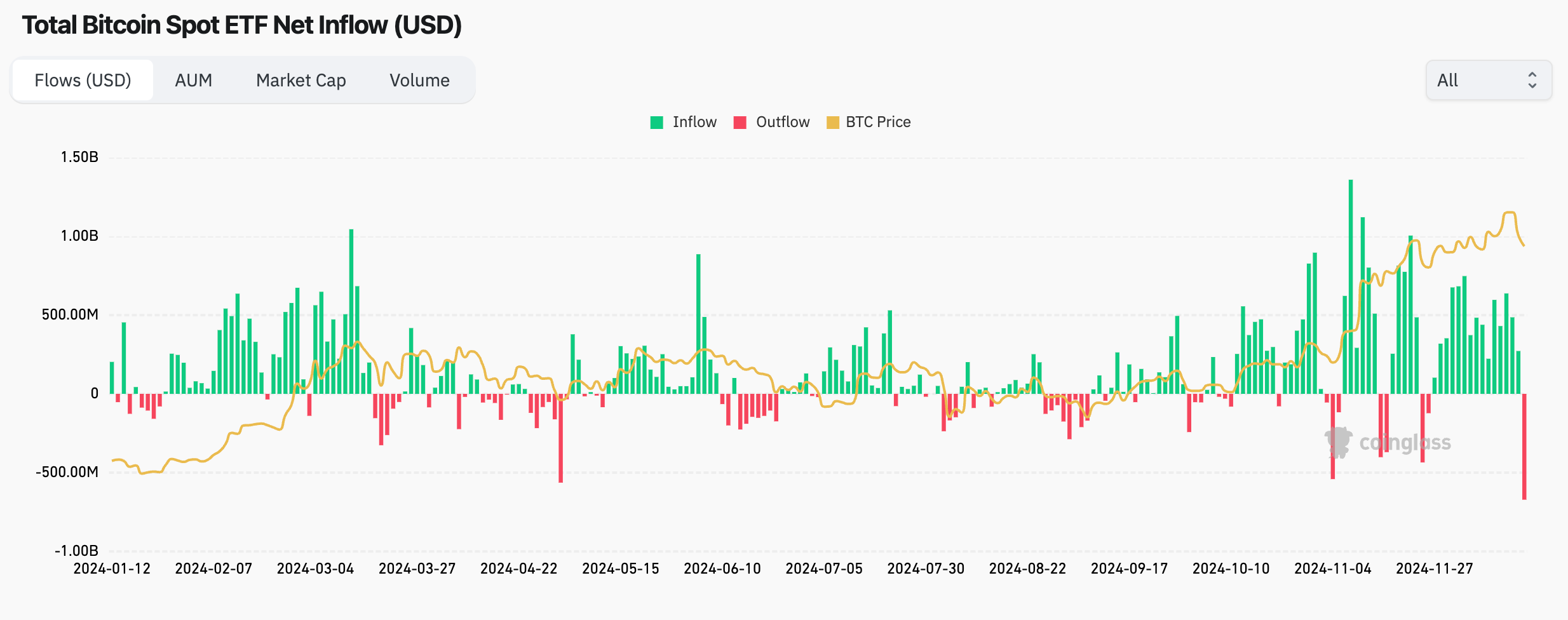

Spot Bitcoin ETFs See Record Withdrawals as CME Futures Premium Signals Weaker Demand

The U.S.-listed spot bitcoin (BTC) exchange-traded funds (ETF) registered record outflows Thursday and the CME futures premium dropped into single digits in a sign of weakening short-term demand.Investors ended a 15-day streak of inflows by withdrawing a net $671.9 million from the 11 ETFs, the largest single-day tally since their inception on Jan. 11, according to data from Coinglass and Farside Investors.Fidelity's FBTC and Grayscale's GBTC led the outflows, losing $208.5 million and $188.6 million, respectively. Other funds registered outflows, too, and BlackRock's IBIT scored its first zero in several weeks.Bitcoin extended its post-Fed losses Thursday, falling to $96,000, down nearly 10% from the record high of $108,268 seen early this week. The bearish sentiment was mirrored in the derivatives market, where the annualized premium in the CME's regulated one-month bitcoin futures fell to 9.83%, the lowest in over a month, according to data source Amberdata.A decline in the premium means cash-and-carry arbitrage bets involving a long position in the ETF and a short position in the CME futures yield less than they did earlier. As such, the ETFs may continue to see weak demand in the short-term.Ether ETFs also registered a net outflow, $60.5 million. That's the first since Nov. 21. Ether has dropped 20% since levels above $4,100 before Wednesday's Fed decision.

Read More

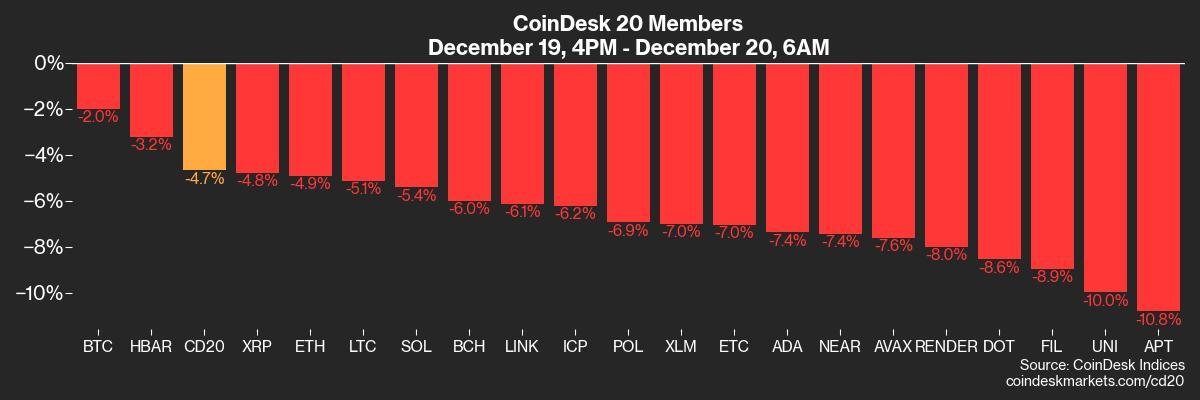

Dogecoin's 11% Drop Leads Losses in Crypto Majors as Bitcoin Sours Festive Mood

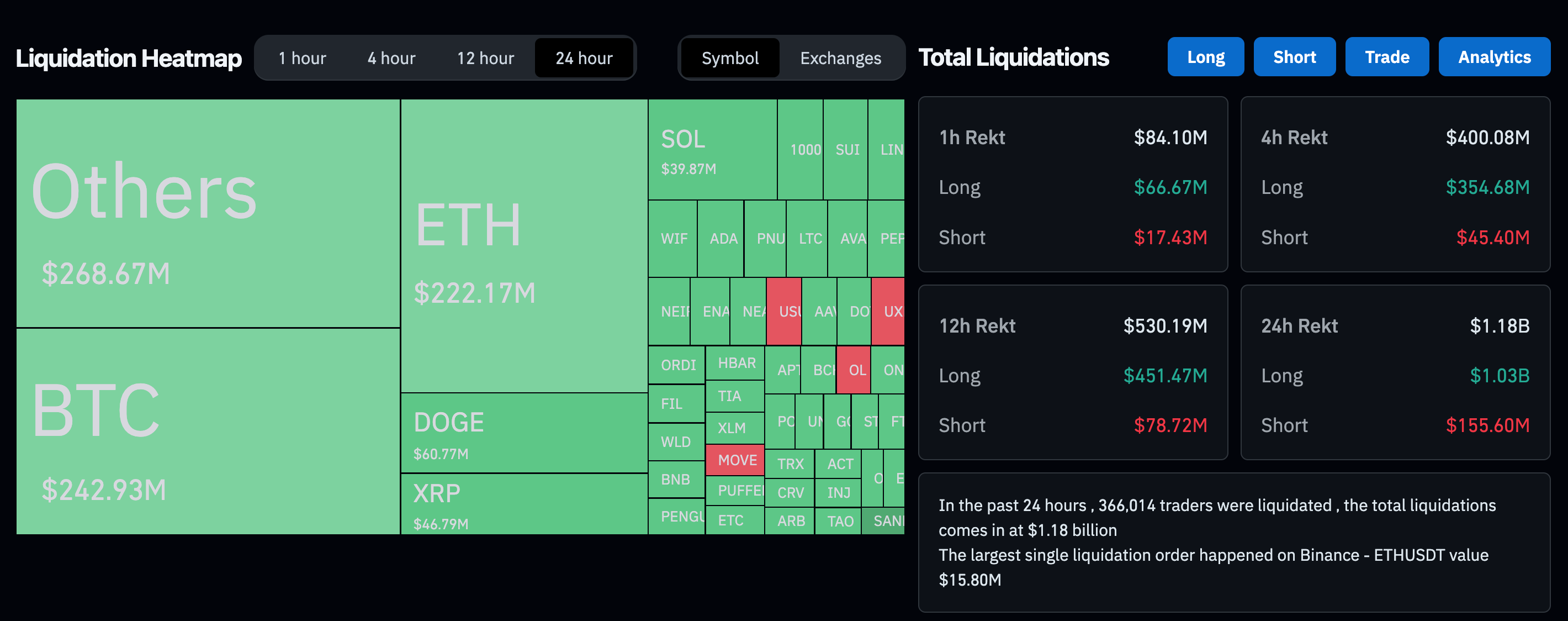

Losses in bitcoin (BTC) and other crypto majors extended to their third straight day, as risk-off behavior after this week’s FOMC meeting and general profit-taking contributed to heavy market sentiment.BTC dropped 4.2% in the past 24 hours, with Solana’s SOL, ether (ETH) and Cardano’s ADA falling as much as 9%. Dogecoin slid the most with an 11% drop, extending weekly losses to over 21%.The broad-based CoinDesk 20 (CD20), an index of the largest tokens by market cap, fell 5.5%. That spread over to futures markets, with over $890 million in long and short liquidations in the past 24 hours.Reaction to a hawkish FOMC triggered a sharp selloff across all risk assets on Wednesday and Thursday. Nasdaq plummeted 3.5%, S&P 500 dropped 2.9% and BTC declined more than 6% since the meeting, where Fed chair Jerome Powell hinted at only a few rate cuts in 2025.Powell then said at a post-FOMC press conference that the central bank wasn’t allowed to own bitcoin under current regulations — in response to a question about President-elect Donald Trump’s strategic reserve promises.Traders at Singapore-based QCP Capital attributed the market crash to overly bullish sentiment in the past month.“While it is easy to blame the selloff on the Fed’s hawkish cut, we believe the root cause of the morning’s crash to be market’s overly bullish positioning,” QCP said in a Telegram broadcast. “Since the election, risk assets have enjoyed an impressive one-sided run, leaving the market extremely vulnerable to any shocks. While the Fed's 25bps cut was expected, the source of panic can be attributed to the dot plot, which was revised lower. Due to persistent inflation, the Fed now projects two rate cuts for 2025 compared to the market’s consensus of 3 rate cuts,” QCP added.A drop in bitcoin comes amid an otherwise bullish period for the asset.December tends to be historically bullish for bitcoin in a move colloquially termed the "Santa Claus Rally." Data from the past eight years shows that bitcoin ended December in the green six times since 2015, running at least 8% to as much as 46% (in the outlier year of 2020).Seasonality is the tendency of assets to experience regular and predictable changes that recur every calendar year. While it may look random, possible reasons range from profit-taking around tax season in April and May, which causes drawdowns, to the generally bullish November and December, a sign of increased demand ahead of holiday season.

Read More

As Bitcoin's Post-Fed Price Dip Extends, This Key Contrary Indicator Offers Fresh Hope: Godbole

Bitcoin's (BTC) post-Fed price drop to $96,000 has activated a crucial contrary indicator that has historically marked the end of price pullbacks.On Wednesday, the Fed cut the benchmark borrowing cost as expected but penciled in only two rate cuts for 2025, down from four projected in September. The central bank stressed that it's not interested in participating in a potential government plan to build a strategic BTC reserve.Since then, BTC has dropped over 8%, hitting lows near $96,000 at one point. As of writing, the cryptocurrency changed hands near $97,500, down nearly 10% from the record high of $108,266 reached early this week, CoinDesk data show.The losses have caused the 50-hour simple moving average (SMA) to dip below the 200-hour SMA, confirming a bearish crossover. The pattern suggests that the ongoing pullback could evolve into a deeper one, although it has failed to live up to its reputation during the recent bull run.Bitcoin has experienced a few pullbacks during its post-U.S. election rally from $70,000 to over $100,000, and each of these dips has ended with a bearish crossover of the 50- and 200-hour SMAs.The latest crossover, therefore, offers hope to bulls expecting a renewed move into six figures above $100,000. A potential bounce could face resistance near $106,000, a level identified by the descending trendline, representing the recent price drop. A violation there would open doors for record highs.It's important to remember that patterns don't always play out as expected, and the contrary indicator discussed above may fail, potentially leading to a deeper drop. The first sign of trouble will be if prices move below the overnight low of $96,000, which could expose the swing low of around $91,000 recorded on Dec. 5.

A potential bounce could face resistance near $106,000, a level identified by the descending trendline, representing the recent price drop. A violation there would open doors for record highs.It's important to remember that patterns don't always play out as expected, and the contrary indicator discussed above may fail, potentially leading to a deeper drop. The first sign of trouble will be if prices move below the overnight low of $96,000, which could expose the swing low of around $91,000 recorded on Dec. 5.

Read More

Could Bitcoin Become DeFi’s Collateral of Choice? Lombard Finance Says So